Have you ever heard of GradReady? It’s a free, interactive, online financial literacy resource offered by UW-Stevens Point’s Financial Aid Office and NorthStar Education Services. This resource can be used throughout enrollment and even after you’ve graduated. GradReady contains different learning methods to appeal to anyone’s preferred way of learning. There are videos, downloadable PDFs, interactive components and quizzes to test your knowledge.

I find GradReady to be beneficial and important to keep a financially fit lifestyle. Financial literacy can impact your entire life, so it’s crucial to become financially literate. I encourage UW-Stevens Point students to complete the GradReady program!

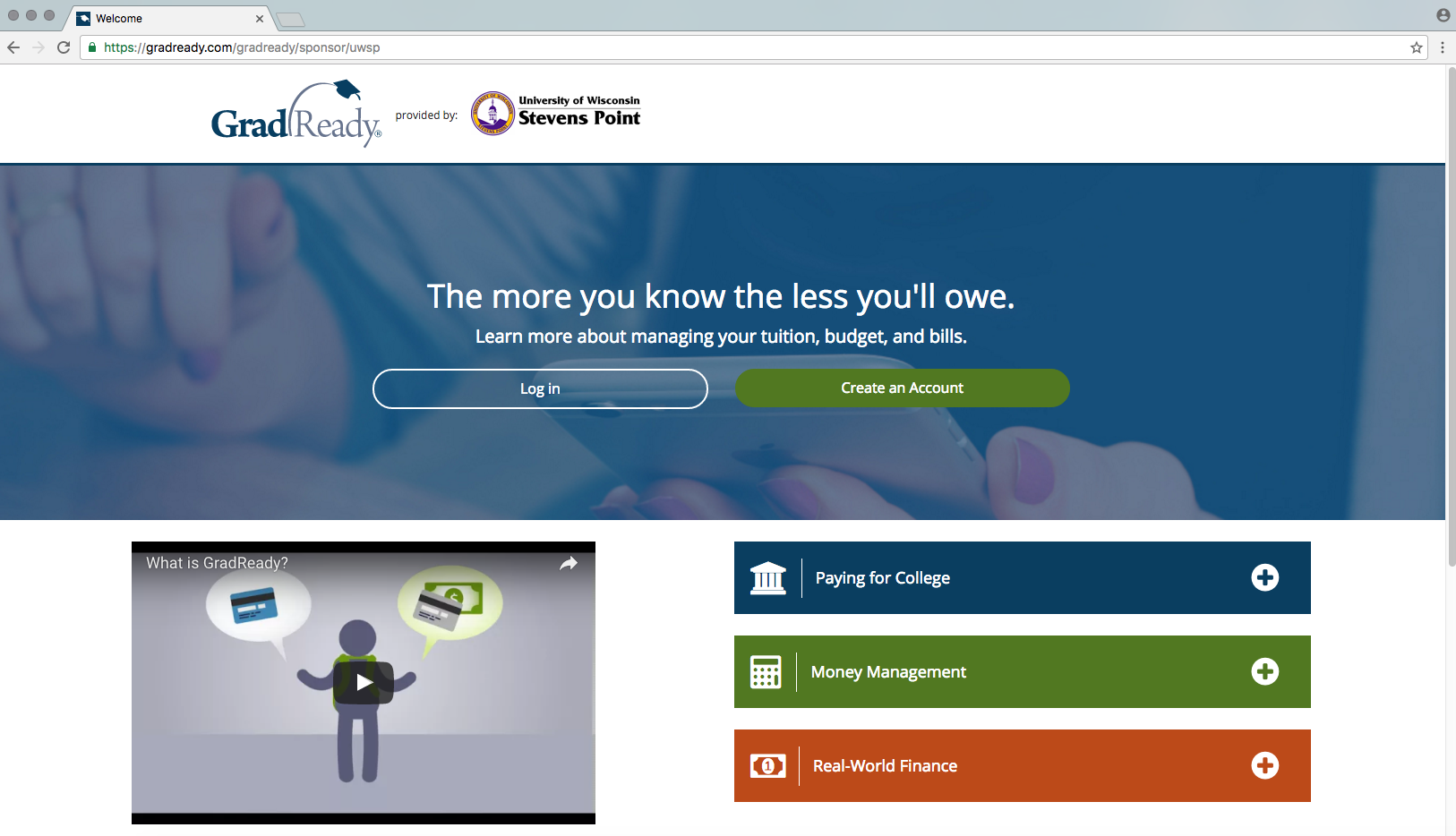

There are three paths to take when completing the GradReady program:

Path 1: Paying for College

The first path includes all you need to know about how to cover the cost of school. You can learn about different federal student loans, the Free Application for Federal Student Aid, work study, scholarships, and other ways to help you pay for college. This path contains an interactive resource where you can create an online, editable finance plan on how to pay for school. As a current UW-Stevens Point student, I find this path the most helpful. I learned so much about loans and what each type of loan means.

Path 2: Money Management

This section covers budgeting, credit, how to track your expenses, identity theft and more. This path also contains the Debt-o-Meter, an interactive resource that allows you to track how manageable your debt is. For me, the money management path was a great refresher from my high school personal finance course.

Path 3: Student Loan Repayment

The third path is all about real-world finance. It gives valuable tips to make sure you’re prepared when it comes to paying back student loans. The path also covers information about mortgages and future financial items, like retirement savings plans. This path contains the Electronic Loan Counselor, an interactive resource to help create a plan to pay back student loans. As a future UW-Stevens Point graduate, I look forward to using the information detailed in this path in my everyday life.

Keep in mind GradReady includes a lot of information – take it one step at a time. On the “My Account” page, you can track your achievements in the program. GradReady is very user-friendly and from my experience it isn’t overwhelming. I signed up myself and am so grateful I did. This program made me comfortable with paying for college, and I would definitely recommend it.

You can sign up for GradReady here using your UW-Stevens Point email address and password.

If you have any questions about signing up or about the GradReady program itself, please don’t hesitate to stop by UW-Stevens Point’s Financial Aid Office, located in room 106 of the Student Services Center. We are happy to help students (and Pointer parents)!