Following bipartisan support in Congress, in January 2020 President Trump signed the United States, Mexico, and Canada Trade Agreement (USMCA). The USMCA effectively modifies rather than replaces the North American Free Trade Agreement (NAFTA), the original trade agreement between the three nations implemented in 1994. Mexico has ratified the new trade deal, while the Canadian Parliament is currently deliberating ratification.

Free trade deals have a primary objective of reducing trade costs by lowering or eliminating tariffs and trade restrictions, in addition to making foreign markets more accessible for domestic industries. NAFTA did that, making the Canadian and Mexican markets more accessible to U.S. companies. However, although it was a free trade deal, NAFTA regulated the free trade with rules of origin requirements which specified that a certain percentage of a product’s content had to be produced in North America. If an imported product did not meet the rules of origin requirements, the importer would be subject to tariffs. This would be an extremely important provision for the automotive industry. NAFTA regulated how auto manufacturers could conduct trade by stipulating that a certain percentage of car content had to be produced in North America. The USMCA modifies this arrangement; it does not replace it.

The effect of the USMCA on the United States? There are some advantages, and some disadvantages. Before we get into that, a little background on trade between Canada, Mexico, and the U.S.

NAFTA

The NAFTA negotiations that were initially started in 1992 under President H.W. Bush came to fruition in 1993 when NAFTA legislation was signed by President Clinton. NAFTA became effective on January 1, 1994, with the goal of reducing tariffs and increasing trade between the three countries. A major goal was to reduce Mexican tariffs on U.S. exports. According to the Congressional Research Service (CRS), before NAFTA U.S. tariffs on imports from Mexico averaged 2% while Mexican tariffs on U.S. exports averaged 10%. NAFTA was a big deal – at the time it was arguably one of the most comprehensive free trade deals ever, it involved three countries and included provisions that covered a variety of new areas for free trade agreements. These included not only trade in merchandise, but also intellectual property rights protection, services trade, agriculture, dispute settlement procedures, cross-border investment, labor, and the environment. The implementation of NAFTA generally resulted in gradual elimination of nearly all tariff and most nontariff barriers on merchandise trade.

NAFTA was also controversial, because it was a trade deal between two wealthy countries and a developing country. Wages, particularly in manufacturing, are lower in a developing country. The concern was that lower wages in Mexico would result in the loss of U.S. manufacturing jobs.

NAFTA led to a closer economic and political relationship between the U.S., Canada, and Mexico. Since 1994 trade between the three countries has increased significantly as indicated below. Although NAFTA has certainly played a role in that growth, other factors such as fluctuating currency exchange rates have also played a role.

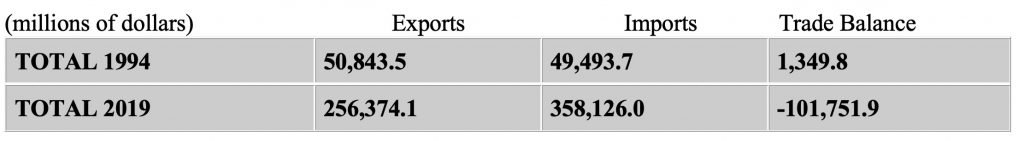

Trade in Goods with Mexico

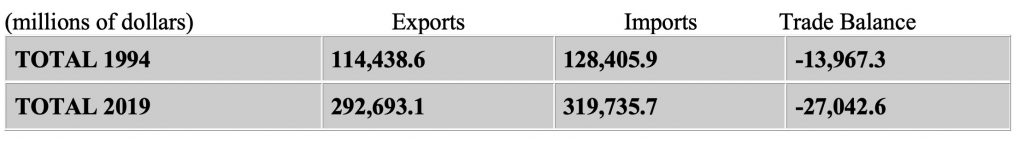

Trade in Goods with Canada

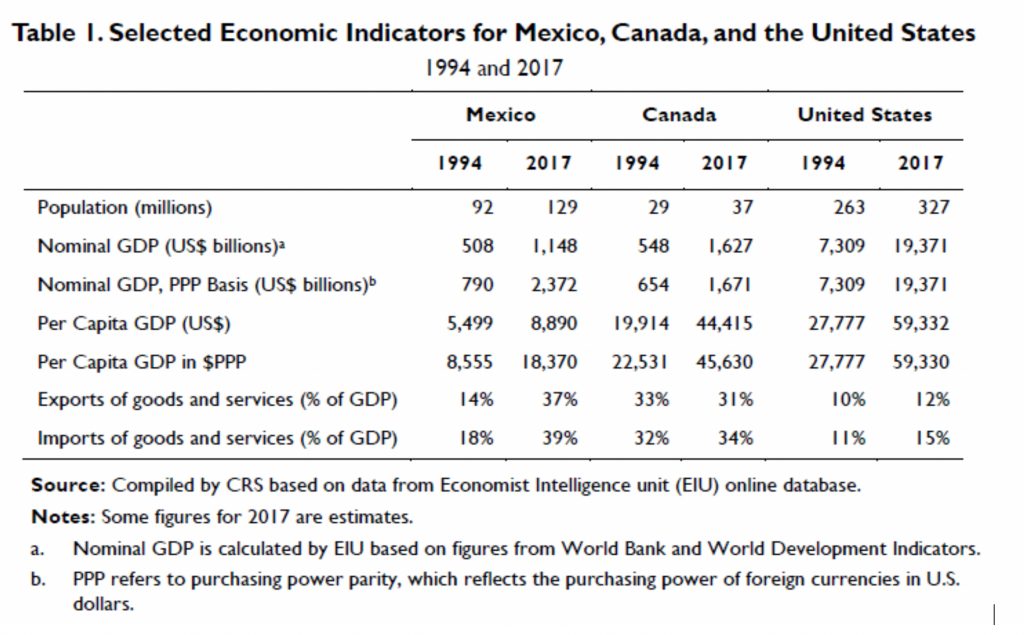

Table 1 below from the Congressional Research Service provides some further insight on trade between the countries. In 2017, the population of the United States was 327 million, compared to 37 million for Canada and 129 million for Mexico. The United States is not only larger in terms of population, it is also wealthier. Per Capita GDP, adjusted for differences in purchasing power, was $59,330 for the U.S., $45,630 for Canada, and only $18,370 for Mexico. Per Capita GDP is a measure of income per individual in each country. The disparity in Per Capita GDP contributes to the trade deficit balance, particularly with Mexico. The average American can buy more stuff from Mexico than the average Mexican can buy from America; and there are almost 3x as many Americans. On average, Americans have more than 6x the annual income than Mexicans. Although there is less income disparity with Canadians, there are almost 10x as many Americans as there are Canadians. Finally, as indicated by the exports and imports of goods and services as a percent of GDP, trade has a much greater impact on the economies of Mexico and Canada than it does on the U.S.

The overall impact of NAFTA on the U.S. economy and jobs? That gets a little harder to measure. According to the Congressional Research Service: “The net overall effect of NAFTA on the U.S. economy appears to have been relatively modest, primarily because trade with Canada and Mexico accounts for a small percentage of U.S. GDP. However, there were worker and firm adjustment costs as the three countries adjusted to more open trade and investment.” That’s another way of saying that given trade with Canada and Mexico, although important, accounts for a relatively small amount of U.S. economic output, NAFTA did not have a major impact on the U.S. economy – overall. However, within certain sectors of the economy significant changes did occur – like the automotive industry.

The Auto Industry and NAFTA

Although it was floated by the Trump Administration, simply pulling out of NAFTA would have had significant negative effects on the U.S. auto industry. Two words can sum up the effect of NAFTA on the auto industry – supply chains. The implementation of NAFTA led to a complex development of supply chains by automotive manufacturers – both domestic and foreign. The flow of automotive products between countries significantly increased as automotive manufacturers took advantage of economies of scale in manufacturing and assembly plants through specialization. As auto makers searched for the most cost effective and efficient methods to build and assemble autos and trucks, supply chains developed and expanded beyond national boundaries.

The automotive industry has been one of the primary industries impacted by NAFTA. According to the U.S. Census Bureau, out of the $358 billion of imports from Mexico in 2019, motor vehicles totaled $75 billion and motor vehicle parts $60 billion. Combined, the auto industry accounted for approximately 38% of imports from Mexico. Exports to Mexico in 2019 included $4 billion of motor vehicles and over $32 billion of motor vehicle parts. Combined, the auto industry accounted for approximately 14% of exports to Mexico. The auto industry also plays a major role in trade with Canada. Out of the $318 billion of imports from Canada in 2019, motor vehicles totaled $43 billion and motor vehicle parts $16 billion. Combined, the auto industry accounted for approximately 18% of imports from Canada. Exports to Canada in 2019 included $32 billion of motor vehicles and approximately $28 billion of motor vehicle parts. Combined, the auto industry accounted for over 20% of exports to Canada. (For more information on exports and imports of other products, click on the U.S. Census Bureau links at the end of this blog.)

Regarding jobs, although there were certainly some manufacturing job losses to Mexico, according to the Center for Automotive Research:

- Product and process technological changes have done more to increase productivity gains and shift employment than has trade; an estimated 87 percent of U.S. manufacturing job losses are due to technology.

- U.S. automakers and suppliers that increase global manufacturing employment also see employment growth in high-wage engineering and R&D jobs, as well as administrative functions in the United States. Expanding NAFTA manufacturing anchored the automakers’ and suppliers’ engineering and R&D in the region—largely within the United States.

- U.S. content of imported vehicles from Mexico was only 5 percent before NAFTA; today, that number is 40 percent. U.S. suppliers have benefited from increased automotive assembly capacity throughout North America.

So, on the one hand, there may have been some loss of manufacturing jobs to Mexico, but the primary driver of manufacturing job loss has been automation, not trade. According to the CRS, auto manufacturing remains an important part of U.S. manufacturing: “Auto parts and final assembly account for a large share of U.S. manufacturing employment: more than 830,000 jobs in 2018, with 597,000 in parts manufacturing and 234,000 in vehicle assembly.” In addition, if U.S. automakers can take advantage of lower costs in Mexico, it could enhance their competitiveness globally which leads to more jobs in the U.S. If they don’t take advantage of lower costs, competitors will. According to the Center for Automotive Research: “nearly 90 percent of the new Mexican light vehicle assembly plant investments announced since 2009 are for assembly plants of Japanese and European automakers.”

USMCA

What’s in the new agreement relative to NAFTA? Here’s a look at some of the major points. More detailed information can be found in the links at the end of this blog.

- The USMCA requires more of a vehicle’s parts to be made in North America in order for the car to be free from tariffs. It requires that 75%, up from 62.5% under NAFTA, of vehicle content be made in the region to qualify for tariff-free treatment. There is also a requirement that 70% of a vehicle’s steel and aluminum must originate in North America.

- The USMCA requires at least 40 – 45% percent of North American car content be made by workers earning at least $16 an hour. The USMCA also stipulates that Mexico must make it easier for workers to form unions.

- The USMCA increases U.S. dairy access up to 3.59% of Canada’s dairy market. However, Canada’s current dairy supply-management system remains intact. Canada also removed its “Class 7” pricing for ultra-high filtration (UHF) milk. In return, the United States expanded import quota levels for Canadian dairy and sugar products.

- The USMC modifies NAFTA provisions affecting trade dispute resolution, intellectual property rights, energy, and government procurement. The USMCA includes new provisions on digital trade and currency misalignment. (For further details, see the link at the end of this blog for the Congressional Research Service: CRS – USMCA.)

- The USMCA has a sunset clause requiring a joint review and agreement on renewal at year 6. If there is no mutual agreement, the USMCA would expire 16 years later.

The impacts on the United States economy?

- Given the increased requirement that 75% rather than 62.5% of vehicle content must be from North America for cars to be tariff free and 40-45% percent of North American car content be made by workers earning at least $16 an hour, there is pressure and incentive for auto manufacturers to shift some jobs from Mexico to the United States (and Canada). According to the Center for Automotive Research, average production wages at General Motors (GM) range from $16.67 per hour for temporary workers to $32.32 for permanent employees who assemble vehicles, for a weighted average of about $26 per hour. At Toyota the hourly production worker wage is approximately $21.29. Hourly production wages in Canada are similar to those at the Detroit 3 (GM, Ford, and Fiat Chrysler). In Mexico, average hourly wages for workers in auto assembly were $7.34 in 2017.

- According to a December 2019 report by the Congressional Budget Office (CBO): “CBO projects that certain imports of motor vehicles and parts that currently benefit from favorable treatment under the North American Free Trade Agreement would not be eligible for favorable treatment under the new agreement. Because of that change in eligibility, CBO projects that duty-free imports of vehicles and parts into the United States from the USMCA partner countries would decline.” In other words, vehicles not achieving the 75% North American content are subject to tariffs, and the CBO projects that the increase in required North American content will not be met by all vehicles. More specifically, the CBO projects an approximately $3 billion increase in tariffs over the next 10 years on U.S. vehicle imports. Those tariffs are NOT paid by a foreign country; they are paid by the U.S. firm importing the vehicles.

- The increase in tariffs and higher wages could add additional costs for U.S. manufacturers. Combined, the increased costs will likely result in higher car prices on certain models. Lower priced models for the auto manufacturers are the most likely to have at least some sourcing from Mexico. Auto manufacturers having manufacturing and/or assembly plants in Mexico include: GM, Ford, Chrysler, Toyota, Nissan, Mazda, Honda, Volkswagen, Kia, Fiat, Hyundai, and Audi.

- The USMCA opens up the Canadian dairy market for U.S. farmers, including Wisconsin. The 3.59% of Canada’s dairy market is higher than the 3.25% that Canada grants members of the Trans-Pacific Partnership trade agreement. (The U.S. had previously withdrawn from the TPP.)

In sum, there are some advantages and disadvantages to the new USMCA. Time will tell the magnitude of those advantages and disadvantages. Time will also tell the commitment of each of the three countries to the new agreement.

Wisconsin Exports to Mexico and Canada

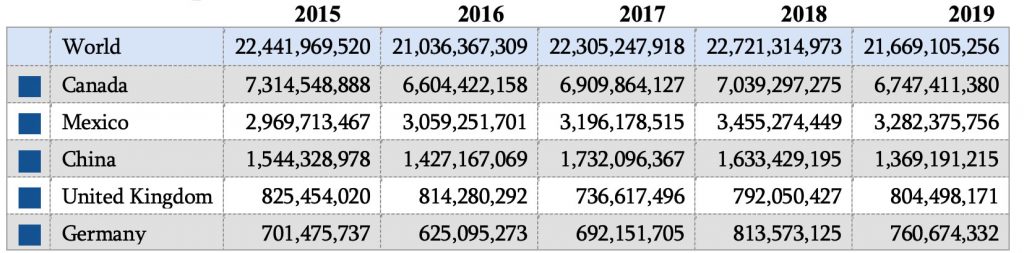

In 2019 Wisconsin exports totaled $21.7 billion (1.3% of all U.S. exports). However, Wisconsin exports declined 4.6% in 2019, and were at their lowest level since 2016. Canada and Mexico have consistently been the two largest export markets for Wisconsin business, and combined account for almost 50% of total Wisconsin exports. Exports to Canada and Mexico also declined in 2019. Exports to Canada were at their lowest level since 2016 and have declined nearly 8% since 2015. Exports to Mexico fell 5% in 2019 but have increased 10% since 2015. Wisconsin exports in 2019 to Canada were $6.7 billion (31% of total exports); exports to Mexico were $3.3 billion (15% of total exports). China, the United Kingdom, and Germany round out the top five export markets for Wisconsin. The ranking of the top five export markets has remained the same over the last five years. In 2019, exports to four out of five of those markets declined – Canada, Mexico, China, and Germany. Only exports to the United Kingdom increased. Relative to 2015, only exports to Mexico and Germany have increased while exports to Canada, China, and the United Kingdom have decreased.

Wisconsin Exports 2015-19

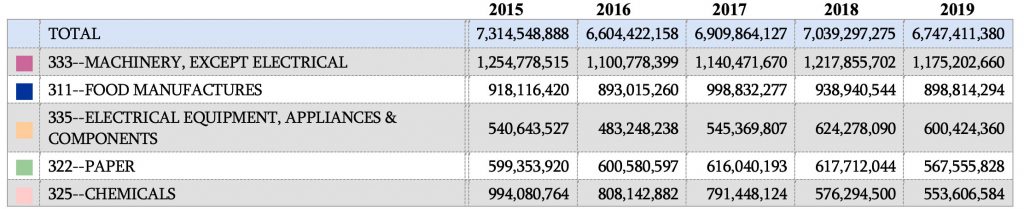

Machinery has consistently been the top product category for exports to Canada, comprising $1.2 billion (over 17%) of the $6.8 billion of Wisconsin exports to Canada. Food products have also been an important export, consistently coming in second and totaling nearly $900 million in 2019 (over 13% of exports), with electrical equipment, paper and chemicals rounding out the top five products. Each of the product categories had export declines to Canada in 2019.

Wisconsin Merchandise Exports to Canada by Product Category 2015-19

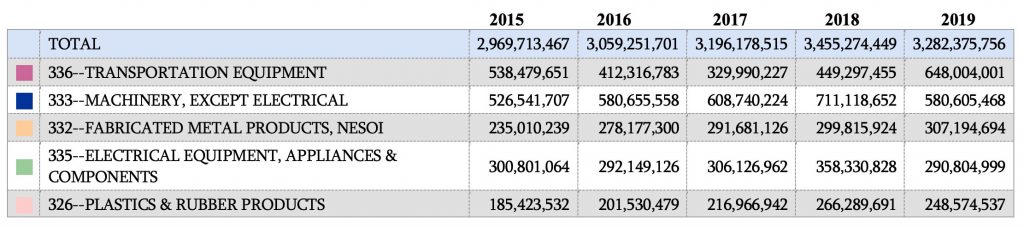

Exports to Mexico featured transportation equipment as the top product category in 2019, comprising $648 million (20%) of the $3.3 billion of exports to Mexico. Machinery came in second at $581 million (18% of total exports); machinery had been the top product category from 2016-2018. Fabricated metal products, electrical equipment, and plastics and rubber products complete the top five products exported to Mexico. Exports of transportation equipment and fabricated metal products increased to Mexico in 2019, while exports of machinery, electrical equipment, and plastics and rubber products declined.

Wisconsin Merchandise Exports to Mexico by Product Category 2015-19

Canada and Mexico also play an important role in Wisconsin imports. In 2019 Wisconsin imports totaled $28.5 billion. China was the leading source of imports, comprising over 22% of total Wisconsin imports and totaling $6.4 billion. Canada ranked second, with Wisconsin importing $4.3 billion (15% of total Wisconsin imports) of Canadian goods. Mexico ranked third at $2.8 billion (10% of total Wisconsin imports).

Kevin Bahr is a professor emeritus of finance and chief analyst of the Center for Business and Economic Insight in the Sentry School of Business and Economics at the University of Wisconsin-Stevens Point.

Sources and Links:

K. Dziczek, B. Swiecki, Y. Chen, V. Brugeman, M. Schultz, and D. Andrea. NAFTA Briefing: Trade benefits to the automotive industry and potential consequences of withdrawal from the agreement, January 2017, Center for Automotive Research.

Center for Automotive Research – NAFTA Briefing

International Trade Administration – TradeStats Express

TradeStats

M. Villareal and I Fergusson, U.S.-Mexico-Canada Free Trade Agreement (USMCA), January 2020. Congressional Research Service.

CRS – USMCA

M. Villareal and I Fergusson, The North American Free Trade Agreement (NAFTA), May 2017. Congressional Research Service.

CRS – NAFTA

M. Villareal, B. Canis, L. Wong, USMCA: Motor Vehicle Provisions and Issues, December 2019. Congressional Research Service.

CRS – USMCA Motor Vehicle Provisions and Issues

M. Villareal and I Fergusson, NAFTA Renegotiation and the Proposed United States-Mexico-Canada Agreement (USMCA), February 2019. Congressional Research Service.

CRS – NAFTA Renegotiation and the USMCA

U.S. Exports to Canada, U.S. Census Bureau

U.S. Exports to Canada

U.S. Imports from Canada, U.S. Census Bureau

U.S. Imports from Canada

U.S. Exports to Mexico, U.S. Census Bureau

U.S. Exports to Canada

U.S. Imports from Mexico, U.S. Census Bureau

U.S. Imports from Mexico

United States-Mexico-Canada Agreement Implementation Act, December 2019. Congressional Budget Office.

USMCA Cost Estimate of Implementation

Wisconsin Imports, U.S. Census Bureau

Wisconsin Imports by Country