The American Rescue Plan has been signed into law by President Biden. To obtain passage by both the House and Senate, the Act was modified from what was initially proposed by the Biden Administration. The modifications include lower income limits for stimulus eligibility and the elimination of any increase in the minimum wage. This blog will provide a summary of selected individual benefits resulting from the passage of the American Rescue Plan.

Stimulus Checks

Eligibility to receive a stimulus check is determined by your adjusted gross income on your tax return. According to the IRS, Adjusted Gross Income (AGI) is defined as gross income minus adjustments to income. Gross income includes your wages, dividends, capital gains, business income, retirement distributions as well as other income. Adjustments to income include such items as educator expenses, student loan interest, alimony payments or contributions to a retirement account.

The IRS may use the adjusted gross income amount on either your 2020 (if you have filed) or 2019 tax return. Individuals with an adjusted gross income of less than $75,000 will receive a $1,400 stimulus check. The amount of the stimulus check is quickly phased out and becomes zero when adjusted gross income becomes $80,000. For those filing as head of household, the phaseout begins at $112,500 and cuts off at $120,000. Married couples filing jointly with adjusted gross income of less than $150,000 will receive $2,800. The amount is quickly phased out and becomes zero when adjusted gross income becomes $160,000.

Dependents (as taken on your tax return) may also increase the total stimulus payment received. For previous stimulus checks, qualified dependents were limited to age 16 or younger. The American Rescue Plan expands eligible dependents to include adult dependents 17 and older. This would include students, elderly adults, and disabled adults who are claimed as a dependent. For each dependent, the taxpayer (not the dependent) may receive up to an additional $1,400 stimulus payment. The amount received for each dependent is subject to the same income limits and phase-outs as listed above for taxpayer eligibility.

Stimulus payments are not taxed. Payments will be made via direct deposit if the IRS has your direct deposit information, otherwise a check will be issued.

Child Tax Credit

The Act temporarily expands the child tax credit in 2021 for certain taxpayers. Subject to income limits, the bill temporarily increases the credit from $2,000 to $3,000 per child for children aged 6 through 17 and to $3,600 per child under 6. The increased portion of the credit will be available for single parents with annual incomes up to $75,000 and joint filers making up to $150,000 a year. For taxpayers making more than those amounts, the credit will be reduced by $50 for every additional $1,000 of adjusted gross income earned.

Unemployment Benefits

The American Rescue Plan also temporarily extends two federal programs that provide unemployment benefits. The programs had been scheduled to end March 14 but are now extended through Sept. 6.

The programs include the Pandemic Unemployment Assistance (PUA) for self-employed, gig and other workers who don’t qualify for state-level assistance, and the Pandemic Emergency Unemployment Compensation (PEUC), which pays extra weeks of state benefits to the long-term unemployed. The Act extends benefits for PUA recipients up to a maximum 79 weeks of benefits, an increase from the previous 50-week limit. PEUC recipients have benefits increased from 24 weeks up to 53 weeks.

In addition to the program extensions, the Act also provides benefit recipients with an extra $300 a week through Sept. 6.

The Act also provides a change to the taxation of unemployment benefits, although it does get somewhat complicated. Due to a Senate amendment, for the first time up to $10,200 of unemployment benefits for individuals would be exempt from taxes – in 2020. For joint filers, if both individuals received unemployment insurance benefits in 2020, each can have up to $10,200 ($24,400 total) exempt from taxes, as long as their combined adjusted gross income is less than $150,000.

Now for the complicated part. The provision applies to unemployment benefits received in 2020 and tax year 2020; not 2021. So, if you have already filed your 2020 tax return, you would have to file an amended return for the tax benefit.

The U.S. Economy and Unemployment

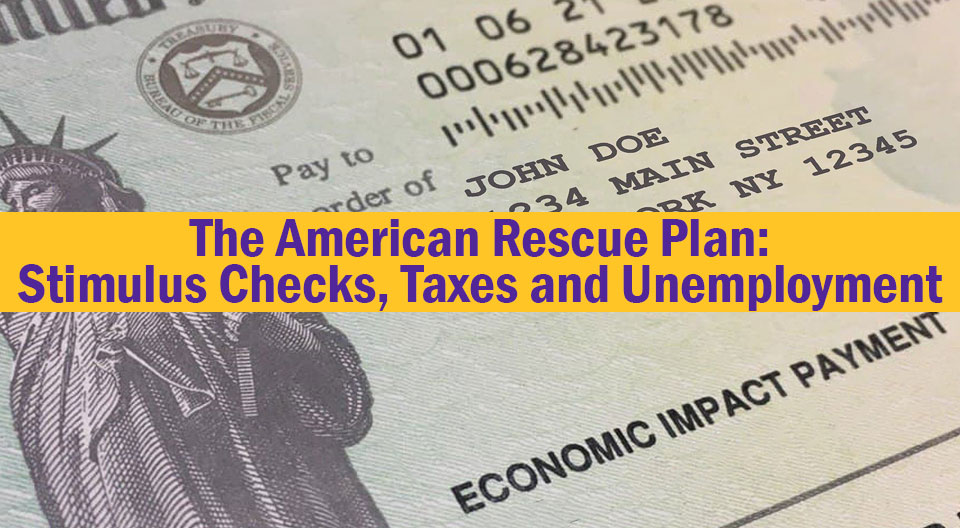

The economic rebound has always been about getting COVID-19 under control. The longer the virus was not controlled, the longer would be the drag on the U.S. economy. The vaccine rollout has picked up and the U.S. economy is improving, but there is still a long way to go – that is demonstrated below and is the reason behind the American Rescue Plan.

The graph below (Chart 1) shows how total nonfarm employment changed between January 2020 and February 2021. 2020 began with employment over 152 million; the onslaught of COVID-19 began in March and quickly resulted in a drop in employment to only approximately 130 million by April. Employment grew back to approximately nearly 143 million by November, but as the graph indicates, employment growth was slowing and became stalled by November, with December employment decreasing. Since December, some good and bad unemployment news. The good news, between December and February total nonfarm employment grew by approximately 500,000. The bad news, there were still approximately 9.5 million fewer employed in February 2021 compared to February 2020.

Chart 1 – All Employees, Nonfarm Payrolls (seasonally adjusted)

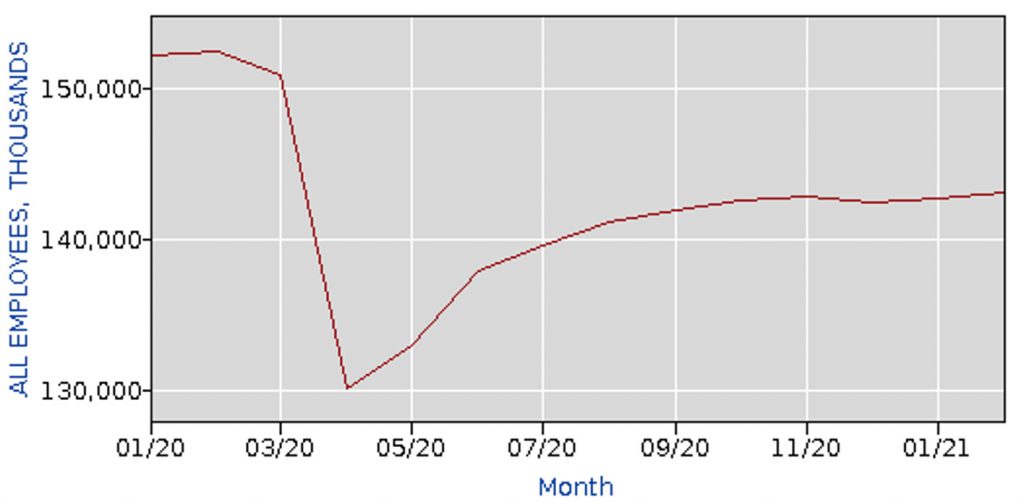

Another problematic note on the economic recovery is long-term unemployment. Long-term unemployment, defined as being unemployed for 27 weeks or longer, has dramatically and consistently increased during the pandemic. The long-term unemployment rate was 4.4% in April 2020 and reached 41.5% in February, the highest level since 2012 following the financial and economic crisis. For many unemployed, returning to the workforce has been difficult and the financial strains enormous.

Chart 2 – Unemployed 27 Weeks or Longer as a Percent of Total Unemployed, Seasonally Adjusted

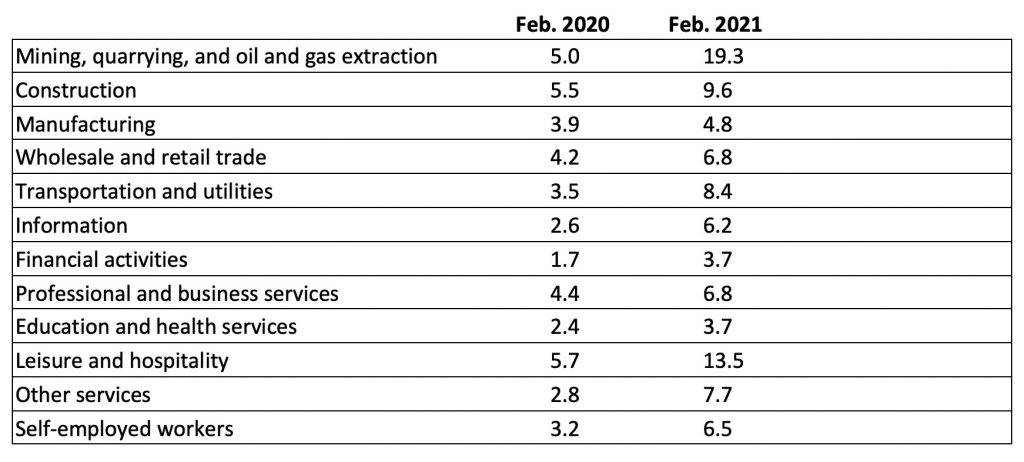

Another measure that there is still a long way to go for the economic recovery is shown in Table 1 below. Table 1 shows the unemployment rate by industry in February 2020, the month before COVID-19 shutdowns began occurring, and February 2021. Although the economy has improved, every industry continued to have a higher unemployment rate in February 2021 than in February 2020.

Table 1 – Unemployment Rates by Industry (not seasonally adjusted)

The economy has been improving as was indicated by the growth in employment by approximately 500,000 between December and February. However, significant challenges remain. Current employment is still 9.5 million less than a year ago, long-term unemployment has significantly and steadily increased despite an improving economy, and industry unemployment remains higher across the board relative to a year ago. Charts 1 and 2 along with Table 1 each indicate that the economic recovery has a long way to go before pre-COVID employment levels are reached. Hopefully, the continued rollout of the vaccine and the stimulus plan will take the economy the rest of the way.

For further information:

- From CNET:

Who’s Eligible for the Stimulus Checks?

Estimating your Stimulus Payment

COVID bill Waives Taxes on up to $20,400 of Unemployment Benefits for Married Couples - From CNN:

A Guide to What you can Expect to get from the $1.9 Trillion Stimulus Package - From CNBC:

Who Qualifies for the $3,000 Tax Credit

Unemployment by Industry - From the U.S. Bureau of Labor Statistics:

Long-term Unemployment - From CNN:

What’s in the $1.9 Trillion Rescue Plan for Small Businesses

Kevin Bahr is a professor emeritus of finance and chief analyst of the Center for Business and Economic Insight in the Sentry School of Business and Economics at the University of Wisconsin-Stevens Point.