Unfortunately, COVID-19 is well into its second year of affecting supply chains, prices and product availability around the world. Global trade plays an extremely important role in product availability and pricing with supply chains playing a crucial role in both. In 2020 the COVID pandemic had a significant, negative impact on global trade and supply chains.

According to the World Trade Organization (WTO), global merchandise trade totaled $17.6 trillion in 2020, down 7.4% from the pre-pandemic $19.0 trillion in 2019. The global economic contraction took a toll on global trade, and supply chains around the world were negatively affected by the growing number of COVID cases through business shutdowns and the impact on worker health. The U.S. accounted for $1.432 trillion of global merchandise trade in 2020, down 12.9% from $1.645 trillion in 2019. In 2020 the U.S. accounted for 8.1% of global trade compared to 8.7% in 2019. The U.S. ranked second to China in global merchandise trade, which accounted for $2.6 trillion of global merchandise trade in 2020 and $2.5 trillion in 2019, which comprised 14.8% and 13.1% of global trade, respectively.

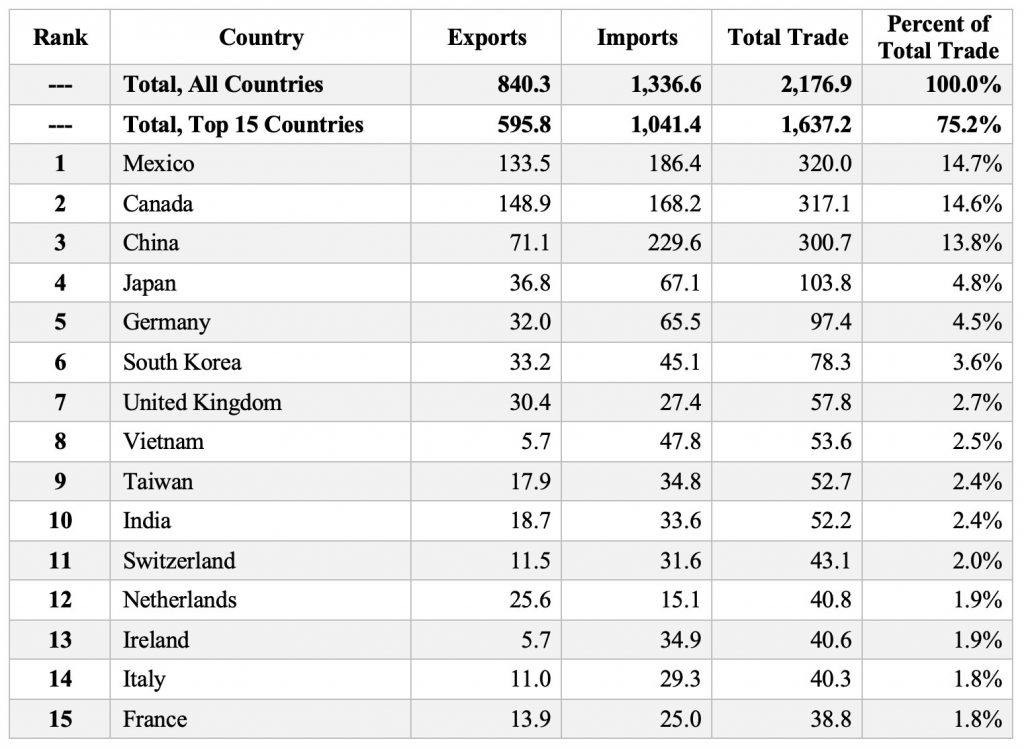

The table below shows the top 15 trading partners with the United States based on the year-to-date total trade through June 2021. The top 15 countries comprise just over 75% of total trade with the U.S. Although the ranking may fluctuate, in recent history Mexico, Canada and China have consistently been the 3 most important trading partners in terms of volume.

U.S. Year-to-Date Merchandise Trade as of June 2021 (billions of dollars) – Top Trading Partners

Imports can have important consequences for supply chains in the United States. Imported goods can be used as inputs in the production process in the U.S. Imports can also affect the supply of goods available to consumers if they are the finished good. Although supply chains have generally improved in 2021, problems remain.

According to the World Trade Organization, the volume of world merchandise trade rebounded in the first quarter of 2021 as COVID vaccinations became available and the global economy showed signs of recovering. First quarter 2021 global merchandise trade increased 4.3% from the same period a year ago. However, trade and economic growth were mixed across countries with generally more developed countries having better growth. According to the WTO, “Inequitable access to COVID-19 vaccines continues to pose the greatest threat to the economic outlook since a failure to protect all people regardless of income leaves populations vulnerable to further waves of infection.” Not only economic inequities, but new COVID variants such as Delta created threats to economic growth and recovery.

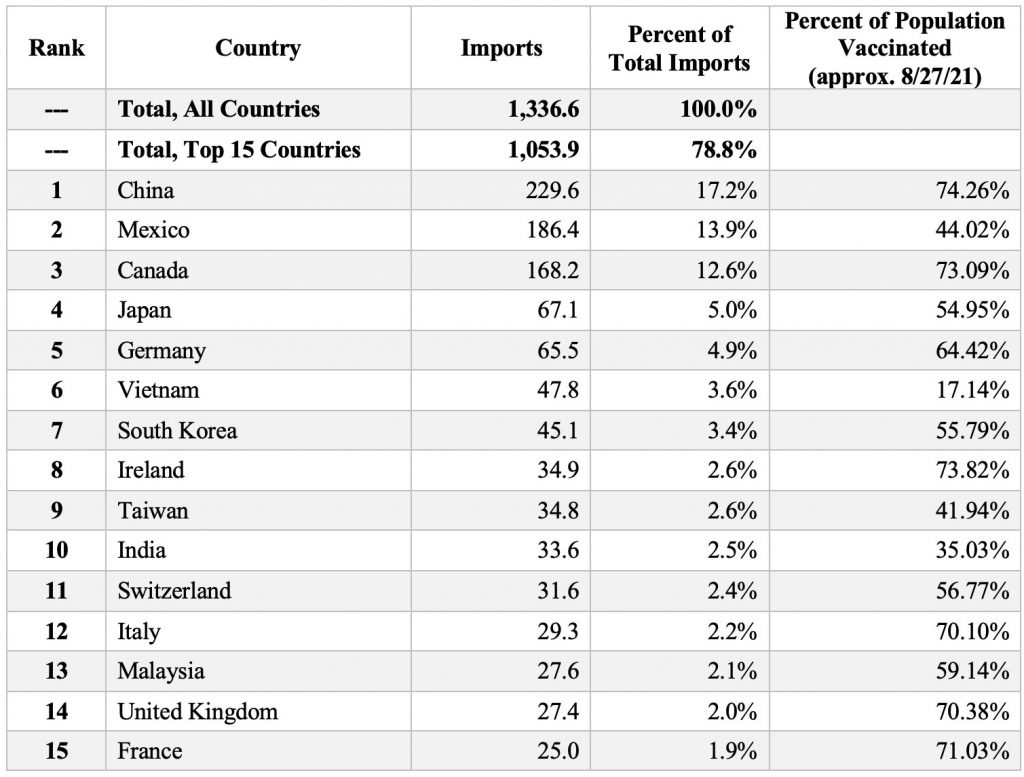

The table below shows the top 15 countries from which the United States imported goods year-to-date through June 2021. In addition, also shown is the percentage of a country’s population that has received at least one COVID shot as of the end of August. A project at the University of Oxford, Our World in Data, compiles data on vaccination rates by country. A vaccinated person refers to someone who has received at least one dose of a vaccine. Any country with low vaccination rates is particularly economically vulnerable if new COVID variants result in an increase in COVID cases. A low vaccination rate for a country that supplies merchandise to the U.S. may also negatively impact supply chains, product availability and prices in the U.S.

The dollar volume of imports understates the importance of imports in the supply chain process. If you import a $1.00 part as a component for manufacturing a $100 product, you have a problem if you can’t get that $1.00 part. COVID disrupted supply chains in a myriad of ways, through business shutdowns, a negative impact on worker health, and resulting product shortages. Low vaccination rates for a country from which the U.S. imports goods will risk that supply chain issues continue or increase due to an increased likelihood of COVID spreading.

Six countries from which the U.S. imported goods had relatively high vaccination rates of at least 70% by the end of August – China (74.26%), Canada (73.09%). Ireland (73.82%), United Kingdom (70.38%), Italy (70.10%), and France (71.03%). For comparative purposes, 60.70% of Americans had received at least one COVID shot. Not surprisingly, typically poorer countries from which the U.S. imports goods had relatively low vaccination rates. Four countries had vaccination rates of less than 50%: 1) Mexico, 2) Vietnam, 3) Taiwan, and 4) India. Mexico ranked second for U.S. imports and had only 44.02% of the population vaccinated for COVID at the end of August. Through June, the U.S. had imported more than $186 billion worth of goods from Mexico. Vietnam ranked sixth on the import list, with the U.S. importing nearly $48 billion of merchandise. Vietnam had a vaccination rate of only 17.14%. Taiwan ranked ninth for imports and India tenth, with vaccination rates of only 41.94% and 35.03% respectively. The U.S. imported nearly $35 billion and $34 billion from Taiwan and India, respectively.

U.S. Year-to-Date Merchandise Imports as of June 2021 (billions of dollars) and Vaccination Rates

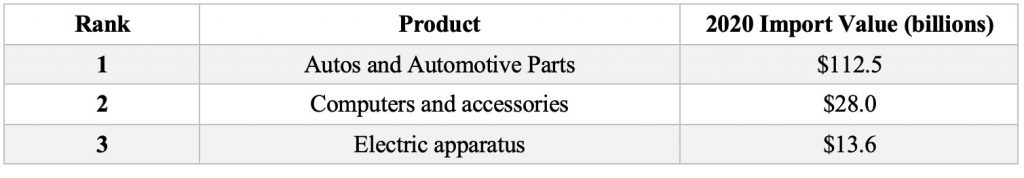

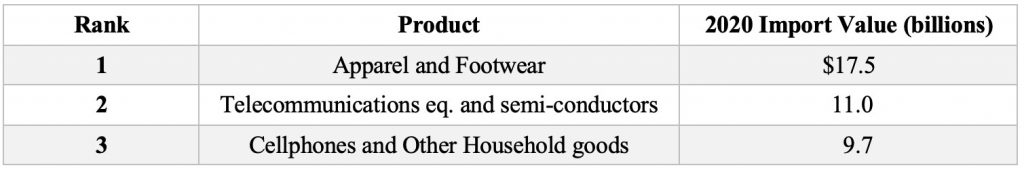

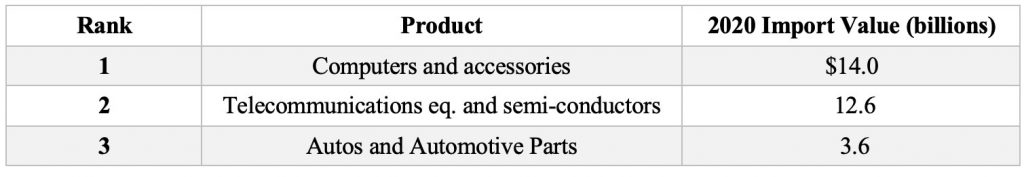

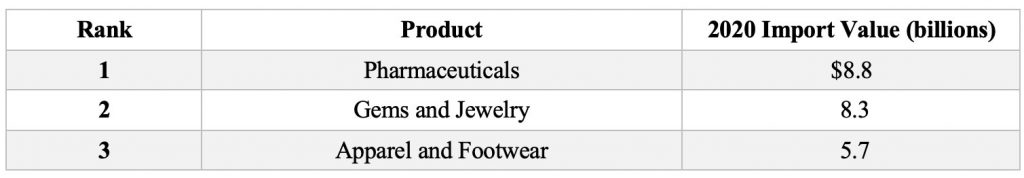

Low vaccination rates for a country from which the U.S. imports merchandise threatens to disrupt supply chains and potentially create product shortages and affect pricing. The top three product categories for imports from each country having a vaccination rate of less than 50% are listed in the tables below. Products are classified according to end use codes as categorized by the U.S. Census Bureau.

Top 3 U.S. Product Imports from Mexico

Top 3 U.S. Product Imports from Vietnam

Top 3 U.S. Product Imports from Taiwan

Top 3 U.S. Product Imports from India

Until COVID dissipates, it can have a detrimental effect on supply chains, product availability and pricing. Particularly vulnerable to the spread of COVID are countries with low vaccination rates. Out of the top 15 countries from which the U.S. imports merchandise, 4 countries had vaccination rates of less than 50% – Mexico, Vietnam, Taiwan, and India. These countries are particularly economically vulnerable to any surge of COVID. However, it is a global economy. What affects those countries, will affect other countries. Companies set-up supply chains between countries in an effort to minimize costs and maximize efficiency and competitiveness. Product availability and pricing may be impacted in the U.S. if supply chains are disrupted, and Mexico, Vietnam, Taiwan, and India may supply parts for goods made in other countries that are eventually supplied to the U.S.

Although there were only 4 countries with vaccination rates of less than 50% at the end of August, there were only 6 countries out of the top 15 U.S. import partners with vaccination rates of greater than 70%. The United States, and 60% of its major import partners had vaccination rates of less than 70%. Until COVID dissipates, the economic cost and risk to supply chains, product availability, and pricing remains.

For further information:

- From Our World in Data: Covid Vaccination Rates

- From the World Trade Organization:

- From the U.S. Census Bureau:

Kevin Bahr is a professor emeritus of finance and chief analyst of the Center for Business and Economic Insight in the Sentry School of Business and Economics at the University of Wisconsin-Stevens Point.