As the military tensions heat up between Russia and the Ukraine and the political tensions increase between the United States and Russia, this blog provides a brief summary of Russia’s energy importance. Russia is a major player in global energy and is particularly important for Europe and China.

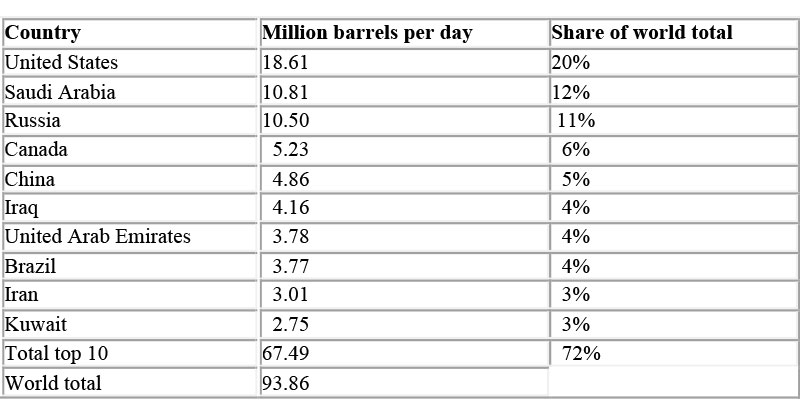

Table 1 below shows the 10 largest oil producers in the world and their share of global production. According to the U.S. Energy Information Administration (EIA), in 2020 Russia was the world’s third-largest producer of petroleum and other energy liquids. Russia had an annual average of 10.5 million barrels per day in total liquid fuels production. The United States ranked first with an annual average of 18.6 million barrels per day and Saudi Arabia ranked second at 10.8 million barrels per day.

Table 1: Largest Oil Producers and Share of Global Production – 2020

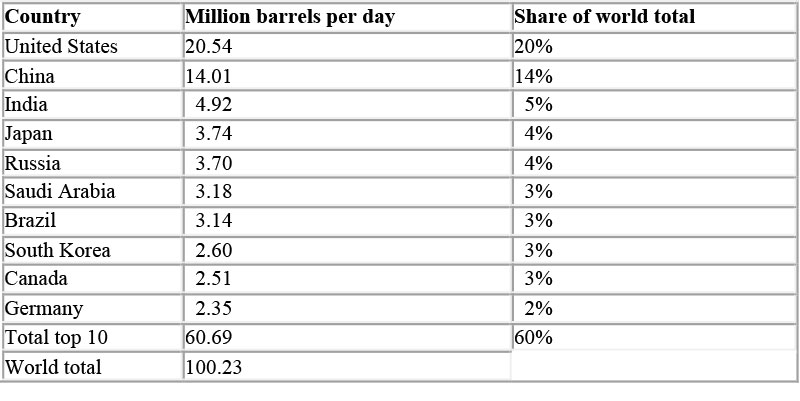

Table 2 below show the 10 largest oil consumers in the world and their share of global consumption.

Table 2: Largest Oil Consumers and Share of Consumption

Note that while Russia consumes 3.7 million barrels per day, it produces 10.5 million barrels, which provides for significant exports of petroleum and other energy liquids. China ranks second in consumption at 14.0 million barrels per day but only ranks fifth in global production at 4.86 barrels per day, meaning it relies significantly on imports of oil. Russia is a key player in making up the difference between consumption and production for China, and China is important to Russia economically. Reuters estimates that approximately 15.5% of China’s oil imports come from Russia (second only to Saudi Arabia) and that China accounts for 15.4% of Russia’s total crude oil exports.

European countries are not major oil producers, but Germany ranks tenth in global oil consumption. Collectively, the European Union relies heavily on oil imports, with Russia once again playing a major role. According to Eurostat, the European dependency on imports for oil and petroleum products reached a record high in 2020, when the European Union relied on net imports for 96.96% of its energy needs. In 2020, Russia accounted for approximately one-third of European oil imports.

It isn’t just oil that is imported, Europe also relies extensively on natural gas imports. According to Eurostat, Europe relies on net imports for approximately 83% of its natural gas. In 2020, Russia provided 23.0 % of natural gas imports, with Ukraine and Belarus providing 12.8% and 10.3% of natural gas imports, respectively. According to the EIA, Europe is Russia’s main market for its oil and natural gas exports. On the flip side, Europe is the main source of Russian oil and natural gas revenues.

In 2020 the United States imported 2.877 billion barrels of crude oil and other liquid energy products according to the EIA. Russia provided 197.7 million barrels, accounting for nearly 7% of U.S. imports. The United States is the world’s largest producer and consumer of natural gas, with production exceeding consumption in 2020. The U.S. does import some natural gas, with approximately 98% of imports coming from Canada.

Energy dependence creates economic dependence and consequently has political consequences, for both the buyers and sellers of energy. Russian energy is important to the global energy market, but the global energy market is important to Russia. The importance of Russia in the global energy market and military tensions between Russia and Ukraine have created uncertainty in world energy pricing and supply. Brent Crude oil is a leading global price benchmark for oil. After beginning the year at $79 a barrel, by late February the price was hovering around $100 barrel. And oil prices affect gas prices, which in turn affect shipping and transportation costs, which in turn affect product costs.

In the long-term the Russian-Ukrainian conflict may lead to energy sourcing and supply changes for several countries, including the Unites States. Short-term, the conflict will impact energy pricing, global economies, and the financial markets.

For further information:

- From the U.S. Energy Information Administration:

- From Europa, an official website of the European Union, statistics on European energy:

- From Reuters, info on Russian exports to China:

Kevin Bahr is a professor emeritus of finance and chief analyst of the Center for Business and Economic Insight in the Sentry School of Business and Economics at the University of Wisconsin-Stevens Point.