It’s not just a U.S. thing, it is global. Increased gas prices and inflation are not just confined to the U.S. They are global problems because global factors have impacted gas prices and contributed to inflation. The unprovoked military attack by Putin against Ukraine created uncertainty in global energy markets given that Russia is the second largest exporter of oil behind only Saudi Arabia. Since December, global oil prices have jumped over 50% which in turn have caused gas prices to increase substantially around the world. Gas and energy prices, as well as lingering supply chain problems, are global factors that have contributed significantly to global inflation.

According to GlobalPetrolPrices.com, the average price of gas globally was $5.36 at the end of May, compared to an average price of $4.79 for the United States. Not surprisingly, gas prices were lower for major oil-exporting countries and less-developed countries that have a lower demand for oil.

The chart below shows the gas price per gallon in U.S. dollars as of May 30 for 14 countries in various locations around the world.

Global Gas Prices in U.S. Dollars as of May 30, 2022

Source: GlobalPetrolPrices.com

| Country | Gas Price/Gallon | Country | Gas Price/Gallon |

| Saudi Arabia | $2.352 | China | $5.495 |

| Russia | $3.034 | Canada | $6.494 |

| Mexico | $4.552 | France | $8.063 |

| United States | $4.790 | United Kingdom | $8.165 |

| Japan | $4.850 | Israel | $8.241 |

| India | $5.086 | Germany | $8.790 |

| Australia | $5.449 | Norway | $10.699 |

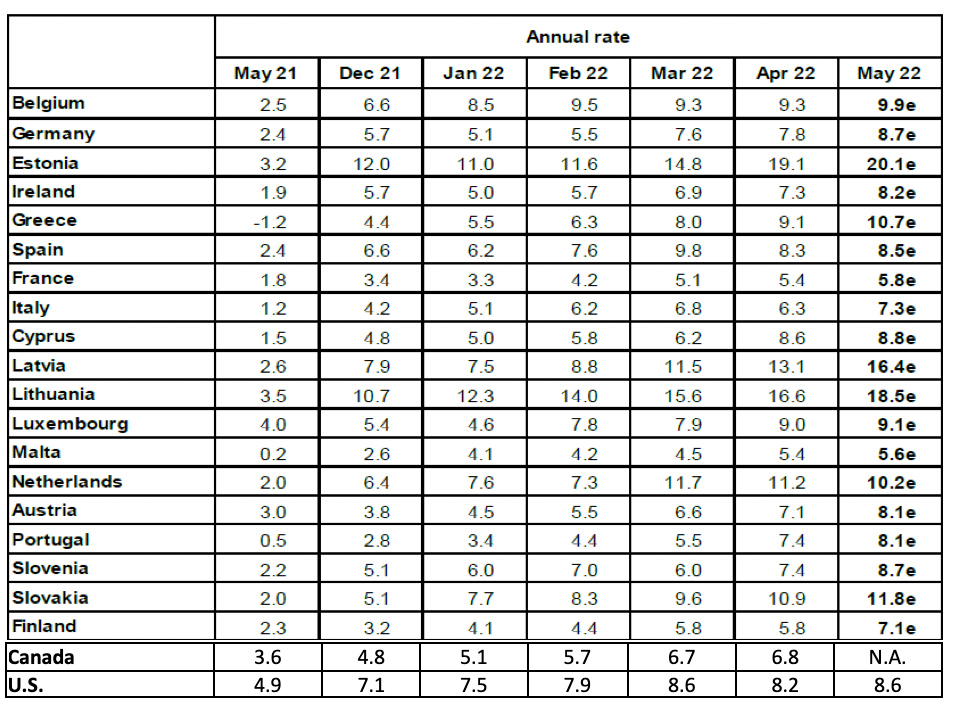

Like gas prices, the rise in inflation has also become a global problem. Many countries are facing their highest inflation rates in decades, including the U.S. Inflation will vary between countries due to differences in economic growth (which is a function of consumer demand, business investment, government spending, and net exports), unemployment, and the supply of goods and services. Although the significance of factors affecting inflation varies by country, energy prices and supply chain disruptions have had a major impact on inflation for many countries around the world.

The table below shows the annualized inflation rate for Europe, Canada, and the United States in May 2021 compared to 2022. Note that the trends in price increases are similar across most countries, with relatively low inflation in May 2021 transitioning to relatively high inflation in 2022. The trends are similar across countries because global factors, primarily the increase in gas and energy prices coupled with continuing supply chain issues initiated by COVID, have impacted global prices. May inflation is estimated to have ranged from 5.6% to 20.1% in the Euro area. In April, Canadian inflation surged to a 30-year high at 6.8%. The annualized U.S. inflation rate rose to 8.6%. in May, led by a 34.6% increase in energy prices over the past 12 months which included a 48.7% jump in gas prices. The increase in energy prices contributed to a broad spectrum of price increases for various products, including shipping costs.

Europe, Canada, and U.S. Annualized Inflation Rates

Sources: U.S. Bureau of Labor Statistics, Eurostat, Canadian Consumer Price Index, Rateinflation.com

N.A. – not available until late June

Putin’s war and Russia’s role as the second largest exporter of oil contributed to the dramatic increase in global energy prices in 2022. The rise in energy prices, coupled with continued supply chain issues, combined to ramp up global inflation significantly in 2022. Modest, short-term relief could be provided to U.S. consumers through gas rebates, gas tax reductions, or other measures, but inflationary pressures will remain until the global issues are solved. Ultimately, the keys to curbing price increases are to solve global energy problems and supply chain issues through long-term planning, rather than short-term reactions to problems.

For further information:

- Info from the Bureau of Labor Statistics: U.S. Inflation

- From Eurostat: European Inflation – May

- Info on global gas prices from GlobalPetrolPrices.com

- From the Bank of Canada: Canadian Inflation

- Global Inflation from rateinflation.com

Kevin Bahr is a professor emeritus of finance and chief analyst of the Center for Business and Economic Insight in the Sentry School of Business and Economics at the University of Wisconsin-Stevens Point.