There are two broad factors that affect prices – demand and supply. Generally, inflation is caused when there is a change to one of these factors. If the supply of goods is reduced for a given demand, prices (inflation) will increase until a higher price level is reached that balances the demand to match the reduced supply. If the demand for goods is increased for a given supply, prices (inflation) will increase until a higher price level is reached that balances the supply of goods to match the increased demand.

In March 2022, the Federal Reserve began raising the federal funds rate to temper consumer and business demand to counter increasing inflation. Increasing interest rates reduces consumer and business borrowing, and consequently demand. In an unusually aggressive move, the Federal Reserve increased the federal funds rate by three-quarters of a percent (75 basis points) in both June and July, reacting to the 9.0% inflation reported for June. Although economic conditions can change, more rate increases are expected through 2023. In August, Federal Reserve Chairman Jerome Powell reaffirmed the Fed’s commitment to fighting inflation and acknowledged increased interest rates may cause some pain for consumers and businesses. The challenge for the Federal Reserve – increase interest rates to reduce consumer and business demand and decrease inflation while keeping interest rates at a level that fosters economic growth.

However, the current economic environment is unique. It’s not just increased consumer and business demand that caused inflation. Inflation has been driven by a three-pronged attack – increased consumer and business demand, supply chain issues, and increased energy prices. Consumer and business demand increased as the economy strongly rebounded following the impact of COVID in 2020. Although demand rebounded, supply chain problems appeared and persisted. Supply chain problems, combined with oil prices increasing over 50% in 2022 due to Putin’s war on the Ukraine, significantly contributed to growing inflation. While the Federal Reserve can temper consumer and business demand by increasing interest rates, it cannot control supply chain issues or energy prices.

The automotive industry provides the prime example of how supply chain issues can drive price increases rather than demand. Since the impact of COVID in 2020, the auto industry has suffered supply chain problems, particularly in the offshore sourcing of semiconductors which in turn significantly limited the supply of new vehicles.

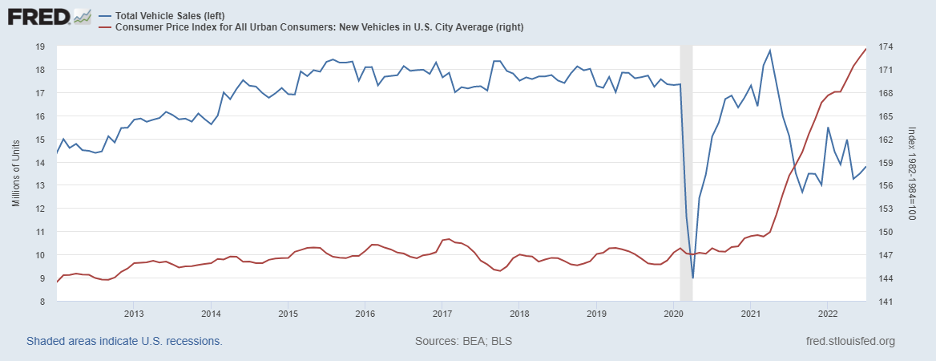

The graph below shows total vehicle sales and the consumer price index for new vehicles since January 2012. The blue line shows total vehicle sales (seasonally adjusted annual rate) as indicated in millions of units by the left axis. The red line shows the Consumer Price Index for New Vehicles as indicated by the right axis. Although there were a few minor ups and downs, overall the trend for vehicle sales was a gradual increase from January 2012 through February 2020 with a slight increase in price. Vehicle sales rose from 14.4 million in January 2012 to 17.4 million in February 2020, an increase of 20.8% while the price index for new vehicles rose by only about 3 percent. In March 2020 COVID hit the U.S. economy and vehicle sales plummeted, dropping nearly 50 percent in a two-month period to a low of 8.9 million units in April.

The economic recovery began in May 2020, and as the economy ramped up so did vehicle sales. From a low of 8.9 million units in April 2020, vehicle sales peaked at 18.8 million in April 2021. In one year vehicle sales more than doubled and surpassed the pre-COVID sales peak of 18.3 million in October 2017. While vehicle sales doubled, prices rose by only 2%. And then in 2021, the supply chain problems. A global semiconductor shortage slowed auto manufacturing, resulting in a reduced supply of cars. Since April 2021 vehicle sales have declined and have been volatile, while new vehicle prices increased significantly because of reduced supply. After peaking at 18.8 million in April 2021, vehicle sales dropped to a low of 12.7 million in September 2021, a decline of over 32%. But the drop in sales was not because of a significant drop in demand, it was because of a reduced supply of cars. If the drop in sales was caused by a drop in demand, then vehicle price increases would not be expected. Although vehicle sales declined by 32% in five months, new vehicle prices increased by 6.9%. It wasn’t demand driving the price increase, it was the reduced supply. Since April 2021, it has been up, up, and away for new vehicle prices as supply chain issues persisted. Between April 2021 and July 2022, new vehicle prices increased nearly 16%. Over that same period, vehicle sales declined by over 26% from 18.8 million to 13.8 million. New vehicle sales in July 2022 were lower than at any time between January 2012 and February 2020, before the impact of COVID on the economy.

Total Vehicle Sales and Consumer Price Index for New Vehicles

January 2012–July 2022

In 2022 the Federal Reserve began raising interest rates to reduce consumer and business demand and lower inflation. But it’s not just demand causing inflation. Inflation has been driven by a three-pronged attack – increased demand as the economy recovered, increased energy prices, and supply chain issues. The automotive industry provides the prime example of how supply chain issues can drive price increases rather than demand. While the Federal Reserve can temper consumer and business demand through increased interest rates, it cannot control supply chain issues or energy prices. The battle with inflation will only be won if the three-pronged attack subsides, including demand, supply chain issues, and energy prices.

Kevin Bahr is a professor emeritus of finance and chief analyst of the Center for Business and Economic Insight in the Sentry School of Business and Economics at the University of Wisconsin-Stevens Point.