The impact of tariffs on trade and the U.S. economy has been the subject of much discussion lately, as President Trump has indicated that he will implement a minimum 10-20% tariff on all imports and (at least) a 60% tariff on Chinese goods. A tariff is basically a surcharge paid by a business to the U.S. government for importing goods from a foreign country. Tariffs are paid by the business importing the goods, not the foreign country sending the goods to the United States. In 2023, U.S. imports totaled $3.8 trillion while exports were $3.1 trillion. With the U.S. population at approximately 335 million, import product demand accounted for over $11,000 per U.S. resident in 2023.

U.S. Trade

Trade Overview

First, let’s look at long-term trends in U.S. international trade. The chart below shows the real dollar value (annualized rate) of U.S. imports, exports, and net exports of goods and services from 1947 through the third quarter of 2024, expressed in billions of 2017 dollars. Using real rather than nominal dollar amounts will allow analyzing the changes in each after adjusting for inflation. Net exports are defined as the exports of U.S. goods and services to other countries minus the imports of goods and services from other countries to the U.S. In other words, it shows the U.S. trade balance of goods and services with all countries. The blue line represents real imports, the red line real exports, and the green line real net exports.

Real U.S. Imports, Exports, and Net Exports of Goods and Services 1947-2024 3rd qtr.

(Billions of Chained 2017 Dollars, Seasonally Adjusted Annual Rate)

Blue Line – Real Imports (billions of chained 2017 dollars, seasonally adjusted annual rate)

Red Line – Real Exports (billions of chained 2017 dollars, seasonally adjusted annual rate)

Green Line – Real Net Exports (billions of chained 2017 dollars, seasonally adjusted annual rate)

The globalization of international trade began ramping up significantly in the 1980s with continual increases in both exports and imports; exceptions, however, did occur during global economic downturns. Beginning in 1980, the United States has consistently had negative real net exports (a trade deficit), meaning that the value of real imports exceeded the value of real exports in every year since 1980, except for a brief period in the early 1990s during an economic downturn. The shaded areas of the chart indicate recession periods. Net exports will generally decrease (the trade deficit will lessen) during recessions, as U.S. corporations and consumers buy less from abroad, meaning fewer goods and services will be imported. The United States has the largest economy in the world, which contributes to strong consumer demand for imports. In 2024 both real imports and exports were at record levels in the third quarter, with real imports reaching a record annualized rate of $3.707 trillion while real exports peaked at $2.638 trillion. Real net exports hit an all-time high of $1.069 trillion (annualized rate) in the third quarter of 2024 as the post-pandemic U.S. economy recovered more robustly and quickly than other economies.

For a better understanding of how real imports and exports have grown significantly since 1980, the table below shows the annualized rate of U.S. real imports and exports for the first quarters of 1947, 1980, 2000, and 2024.

U.S. Real Exports and Imports

Over the 33-year period from 1947–1980, real imports increased $340.4 billion while real exports rose $289.3 billion. The globalization of international trade began to significantly increase in the decade of the 1980s. Over the 20-year period from 1980 and 2000, real imports and exports increased $1,267.6 and $897.8 billion, respectively. The rapidly rising trend accelerated for both real imports and exports since the turn of the century. Between 2000 and 2024, real imports and exports increased $1,886.8 and $1,290.9 billion, respectively.

Changes in Trade in Goods with Top Trading Partners since 2017

In 2018 and 2019, the Trump administration initiated a wave of tariffs between the U.S. and several countries, with a focus on imports from China. Although tariffs declined in 2020, tariffs on China generally remained and were kept in place by the Biden administration. The tariffs, combined with increasing political tensions with China, have had a major impact on sourcing by U.S. firms since 2017. Table 1 below shows the 2023 U.S. top trading partners in goods (excluding services), while Table 2 shows the 2017 top trading partners in goods. Table 3 shows the change in exports and imports with the top trading partners between 2017 and 2023.

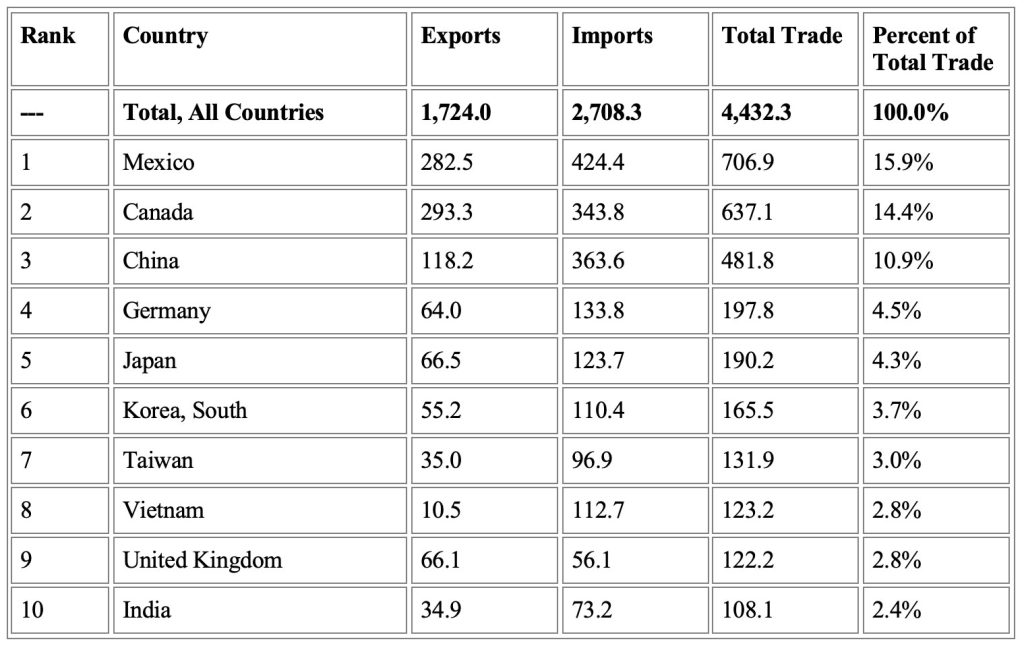

Table 1: 2023 U.S. Top Trading Partners in Total Trading of Goods (billions of dollars)

Table 2: 2017 U.S. Top Trading Partners in Total Trading of Goods (billions of dollars)

Table 3: Changes in Exports and Imports with Top Trading Partners (billions of dollars)

In both 2017 and 2023, the top three trading partners in goods with the U.S. were Mexico, Canada, and China. However, the ranking of trading partners changed, with Mexico rising from third to first and China falling from first to third. In 2023, the top trading partner in goods for the U.S. was Mexico, comprising 15.7% of total trade with $798.8 billion. Total trade with Mexico increased 43.4% from 2017, with exports increasing 33.0% to $323.2 billion and imports rising 51.5% to $475.6 billion. Canada was second with total trade of $774.3 billion in 2023, an increase of 32.9% from 2017. Exports rose 25.1% to $353.2 billion while imports increased 40.4% to $421.1 billion. Total trade with China decreased 9.6% from 2017 to $575 billion in 2023. The decline in trade was caused by a drop of 15.4% in imports from China since 2017 to $427.2 billion in 2023, while exports increased 13.3% to $147.8 billion.

Through October 2024, Mexico, Canada, and China remained the top three trading partners for the U.S., comprising 15.9%, 14.4% and 10.9% of total trade, respectively. Table 4 below shows the volume of trade for the top ten trading partners of the U.S. through October 2024.

Table 4: Top Ten U.S. Trading Partners in Goods (billions of dollars)

Year-to-Date through October 2024

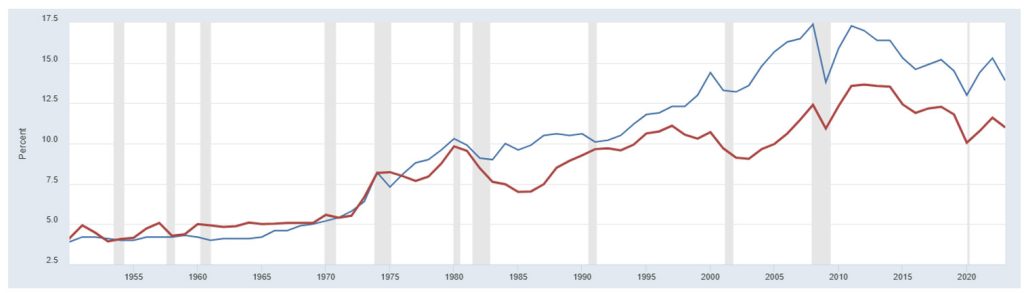

The importance of both imports and exports on the U.S. economy has increased significantly since 1950. The chart below shows imports and exports of goods and services as a percentage of gross domestic product since 1950. Gross domestic product is the value of goods and services produced in the United States. Expressing imports and exports as a percentage of gross domestic product provides an indication as how important imports and exports have been relative to the size of the overall economy.

In 2023, imports of goods and services as a percentage of GDP were 13.9%. Imports as a percentage of GDP have exceeded 12% since 1997 and peaked at 17.4% in 2008. Prior to 1970, imports as a percentage of GDP were only approximately 5% or less. In 2023, exports of goods and services as a percentage of GDP were 11.0%. Exports as a percentage of GDP have exceeded 10% since 2005. Prior to 1970, exports as a percentage of GDP were only approximately 5% or less. The globalization of international trade that began ramping up in the 1980s steadily, and significantly, grew the importance of both imports and exports to the U.S. economy.

U.S. Imports and Exports of Goods and Services as a Percentage of Gross Domestic Product

1950-2023 (Billions of dollars)

Blue Line – Imports of Goods and Services as a Percentage of GDP (billions of dollars)

Red Line – Exports of Goods and Services as a Percentage of GDP (billions of dollars)

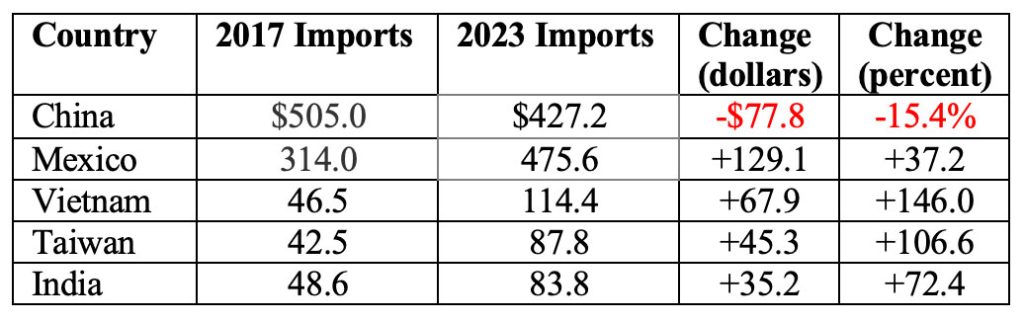

U.S. companies focus on maximizing profitability. The tariffs implemented in 2018, particularly for China, caused many companies to turn away from China for sourcing toward other low labor cost countries. Table 5 below shows the changes in imports of goods with selected low labor cost countries between 2017 and 2023. Imports from China declined $77.8 billion, or 15.4%, while imports from other low labor cost countries surged as the increased tariffs caused U.S. companies to resource imports. On a percentage increase basis, Vietnam was the big winner, with U.S. imports from Vietnam increasing 146.0% since 2017 to $114.4 billion in 2023. In terms of dollars, imports from Mexico increased the most. Between 2017 and 2023, imports rose $129.1 billion, a 37.2% increase since 2017.

Table 5: Changes in Imports of Goods with Selected Low Labor Cost Countries (billions of dollars)

Wisconsin

Mirroring trends in U.S. international trade, exports and imports have become increasingly important for Wisconsin. In 2023, Wisconsin had exports of $28.0 billion, an increase of almost 30% from $22.3 billion in 2017. Wisconsin imports were $39.3 billion in 2023, rising nearly 42% from $27.7 billion in 2017. The trade deficit rose from $5.4 billion in 2017 to $11.3 billion in 2023.

The table below shows the top three trading partners for Wisconsin in 2023. Ranked in order for both imports and exports were Canada, Mexico, and China. The top three trading partners accounted for 46% of the total $39.3 billion of imports and 51% of the total $28.0 billion of exports.

Wisconsin Top Trading Partners 2023 (millions of dollars)

Tariffs

Tariffs are basically a tax on the U.S. business importing the goods from a foreign country. Tariffs raise costs for the American importer, and may hurt foreign businesses if fewer goods are imported by U.S. firms. Because foreign businesses are usually hurt by U.S. tariffs, foreign countries will usually impose tariffs on U.S. exports in retribution. Tariffs have generally been used for protecting domestic producers from foreign competition, especially for goods deemed strategically important and when competition deemed unfair. They have also been used by governments in an attempt to strengthen positioning when negotiating trade agreements. Finally, tariffs have also been used to raise government revenue, although tariffs have not provided a significant share of revenue for the U.S. government since the early 1900s.

The United States is a member of the World Trade Organization (WTO) and partner in a variety of trade agreements with other countries. The WTO establishes rules for member nations to promote global trade and minimize tariffs between member nations to further global economic development. The President, however, has broad authority over tariff rates. Generally, through a variety of statutes, Congress has authorized the President to adjust tariff rates in response to specific concerns related to U.S. foreign policy and national security interests, or that require an administrative finding by a U.S. agency.

U.S. Tariff Rates

The chart below shows the weighted mean applied tariff rate for the United States since 1989. The weighted mean applied tariff is the average of effectively applied rates weighted by the product import shares corresponding to each partner country. Between 1989 and 2004 the weighted mean tariff rate was below 4%. Since 2005 the weighted mean tariff rate has been below 2%, except in 2019 when U.S. tariff rates peaked. In 2018 and 2019, the Trump administration initiated a wave of tariffs between the U.S. and several countries, with a focus on imports from China. According to the World Bank, the U.S. mean applied tariff rate increased from 1.59% in 2018 to 13.78% in 2019 before declining to 1.52% in 2020.

United States Weighted Mean Applied Tariff 1989-2022

Implementing a minimum 10-20% tariff on all imports, with at least a 60% tariff on Chinese goods, would substantially increase the weighted mean tariff rate to potentially its highest level since the early 1930s when the average tariff rate was approximately 20%. The Smoot-Hawley Tariff Act of 1930 increased tariffs on imports of farm products and manufactured goods in an unsuccessful attempt to pull the United States out of the Great Depression. Foreign countries, also facing economic difficulties, retaliated by raising tariffs on American goods. As a result, the U.S. depression worsened, world trade declined significantly, and the global economy struggled.

Tariffs and Government Revenue

Tariffs were the primary source of U.S. government revenue in the early days of the United States. The graph below shows tariffs as a percentage of total federal revenue since 1798. Tariffs have not provided a meaningful share of revenue for the U.S. government over the last century. As the U.S. economy grew and business and industrial development occurred, taxation became the preferred method for the U.S. government to raise revenue for a variety of reasons.

Tariffs hurt the competitiveness of any importing business, as tariffs resulted in increased costs to the importing business. In many cases, U.S. businesses used foreign sourced inputs in production or supplied foreign sourced products to consumers. As a result, consumers generally paid higher prices from the implementation of the tariffs. In addition, as economies grew and businesses developed around the world, international sourcing options increased for a variety of inputs and products. If the U.S. placed tariffs on goods from a particular country, that would likely result in that country placing tariffs on U.S. exports. The increased costs of U.S. products would result in countries at least exploring alternative sourcing options.

As a source of government revenues, not only are taxes a more consistent form of revenue, but individual income taxes are progressive while historically tariffs have been a regressive tax. In the United States, there are seven tax brackets that apply to federal income taxes. A specific tax rate applies to income in a particular bracket. As taxable income increases, higher tax rates will apply to higher income brackets. Federal income taxes are viewed as progressive, as progressively higher tax rates apply to increasingly higher income levels. Historically, tariffs have been a regressive tax. Increased costs to businesses due to tariffs are generally at least partially passed on to consumers. Tariffs have been regressive as lower income consumers have generally paid a greater share of after-tax income on the increased costs due to tariffs than higher income consumers. The chart below shows tariffs as a percentage of total federal revenue since 1798.

Tariffs as a Percentage of Total Federal Revenue 1798-2023

In fiscal year 2023, tariffs raised approximately $80 billion, only about 2 percent of the $4.44 trillion in total Federal tax revenue. Individual income taxes, corporate taxes, and payroll taxes provided 49, 36, and 10 percent of total Federal tax revenue, respectively.

Tariffs and Imports

The table below shows the top import product categories for the United States through October 2024. Any broad application of tariffs would impact the costs and prices of the following products.

U.S. Imports of Goods by End-Use Category, Year-to-Date through October 2024

Capital goods was the top product category for imports with over $793 billion in imports year-to-date through October. Capital goods play an important role in increasing productivity and U.S. competitiveness. The top products imported in the capital goods category included computers (and computer accessories), electrical devices, telecommunications equipment, industrial machinery and semiconductors. Consumer goods ranked second, with imports of over $661 billion through October. The top products imported in consumer goods were pharmaceuticals and cell phones, with other imports including appliances, furniture, apparel, toys, jewelry, and sporting goods. Industrial products ranked third with imports of over $550 billion through October, while automotive and food (including feed and beverages) had imports of approximately $398 and $177 billion, respectively.

Summary

President Trump has indicated that he will implement a minimum 10-20% tariff on all imports, with at least a 60% tariff on Chinese goods. A tariff is basically a surcharge paid by a business to the U.S. government for importing goods from a foreign country. Tariffs are paid by the business importing the goods, not the foreign country sending the goods to the United States. The ultimate impact of tariffs on the economy remains to be seen, as well as how the tariffs would affect American economic leadership in the world. Factors affecting how tariffs would impact the U.S. economy include the magnitude and scope of tariffs, how long the tariffs remain in place, retribution on U.S. exports by foreign countries, foreign countries finding sourcing options instead of the U.S., and the extent to which imports were ramped up by U.S. businesses in an effort to avoid tariffs.

The importance of both imports and exports on the U.S. economy has increased significantly over time.

In 2023, imports of goods and services as a percentage of GDP were 13.9%, while exports were 11.0% of GDP. In recent history the top three trading partners for the United States has been consistent, but the ranking of the top three trading partners has changed. In both 2017 and 2023, the top three trading partners in goods with the U.S. were Mexico, Canada, and China, comprising over 40% of total U.S. trade. However, the ranking of trading partners changed, with Mexico rising from third to first and China falling from first to third.

The growing importance of imports and exports for Wisconsin reflects trends in U.S. international trade. Exports increased almost 30% to $28.0 billion in 2023 from the $22.3 billion in 2017 while imports rose nearly 42% to $39.3 billion in 2023 compared to $27.7 billion in 2017. The top three trading partners, Canada, Mexico, and China, accounted for 46% of the total $39.3 billion of imports and 51% of the total $28.0 billion of exports.

The application of a broad tariff on all imports would generally be a significant reversal from tariff policy in recent years. Since 2005 the U.S. weighted mean tariff rate has been below 2%, except in 2019 when the U.S. mean applied tariff rate peaked at 13.78% as a result of tariffs imposed by the Trump administration. Implementing a minimum 10-20% tariff on all imports, with at least a 60% tariff on Chinese goods, would substantially increase the weighted mean tariff rate to potentially its highest level since the early 1930s when the average tariff rate was approximately 20%. Tariffs have not provided a meaningful share of revenue for the U.S. government over the last century, and in fiscal year 2023 tariffs accounted for only about 2 percent of Federal tax revenue.

The ultimate impact of tariffs on the economy, including prices and trade, and how tariffs will impact American leadership in the global economy, is very uncertain. However, what is certain is that 2025 is shaping up to be a very interesting year.

For further information:

- From the U.S. Census:

- From CNN: Why Biden is Keeping Trump’s China Tariffs in Place

- From Investopedia: What Are Tariffs and How Do They Affect You?

- From Forbes: A History of Tariffs

- From the Council of Economic Advisors: Tariffs as a Major Revenue Source

- From The Centre for Economic Policy Research (CEPR) in Europe: U.S. Tariffs are an Arbitrary and Regressive Tax

- From the CATO Institute: The Regressive Nature of the U.S. Tariff Code

- From Miguel Acosta (Federal Reserve Board) and Lydia Cox (Yale University): The Regressive Nature of the U.S. Tariff Code: Origins and Implications

- From the Congressional Research Service: U.S. Tariff Policy: Overview

- From the World Bank: U.S. Mean tariff Rate

- From the U.S. Census Bureau: U.S. Foreign Trade Data (see Exhibit 8)

- Information on the World Trade Organization: WTO

- From the U.S. International Trade Administration (Trade Stats Express): Trade Data by State

Kevin Bahr is a professor emeritus of finance and chief analyst of the Center for Business and Economic Insight in the Sentry School of Business and Economics at the University of Wisconsin-Stevens Point.