President Joe Biden has unveiled his $1.9 trillion American Rescue Plan, which would be the third major economic stimulus plan in response to the detrimental impacts of COVID-19. In March 2020, the largest fiscal stimulus in the history of the U.S. was passed by Congress – the $2 trillion Coronavirus Aid, Relief, and Economic Security (CARES) Act. The $900 billion Coronavirus Response and Relief Supplemental Appropriations Act followed in December. These acts included provisions aimed at helping small businesses, non-profit organizations, state and local governments, and individuals through rental and unemployment assistance. (For greater detail, see the link below to the U.S. Treasury.)

Both acts featured direct stimulus payments to individuals (with income limitations). The CARES Act initially provided Economic Impact Payments to American households of up to $1,200 per adult for individuals and $500 per child under 17-years-old – or up to $3,400 for a family of four. The Coronavirus Response and Relief Supplemental Appropriations Act authorized additional payments of up to $600 per adult and up to $600 for each qualifying child.

Enter the third round of COVID-19 economic stimulus programs – the American Rescue Plan. First, we’ll discuss briefly what’s in the plan. Next, we’ll discuss why another round of fiscal stimulus is necessary. The plan will likely be considered by Congress in February.

What’s in the American Rescue Plan?

The economic aid proposal includes three general categories: 1) approximately $415 billion to improve the response to the virus (including reopening schools) and the rollout of COVID-19 vaccines, 2) approximately $1 trillion in direct relief to households, and 3) approximately $440 billion for small businesses and communities, including emergency funding to state and local governments.

The details include (more details available through the links below):

- Another round of direct stimulus payments to individuals for up to $1,400 (subject to income limitations) – on top of the $600 checks delivered by the December legislation.

- Supplemental unemployment insurance would increase to $400 a week from the current $300 and would be extended to September.

- $350 billion in emergency funding for state and local governments.

- $15 billion in grants to small businesses, as well seed money for as much as $175 billion in low-interest business loans.

- $160 billion for vaccine distribution, an expansion of testing, and support to reduce critical supply shortages.

- $10 billion in cybersecurity and information technology spending.

- $25 billion in rental assistance, in addition to the $25 billion allocated in the COVID-19 relief legislation passed by Congress in December.

- $5 billion to help struggling renters pay utility bills.

- Creation of a $25 billion emergency fund and adding $15 billion to an existing grant program to help child-care providers.

- $130 billion to aid schools in reopening and supporting safety measures for in-person learning.

- Extension of the federal eviction moratorium to September 30, as well as allowing people with federally guaranteed mortgages to apply for forbearance until September 30.

- Increasing the minimum wage to $15/hour.

- Increasing the Child Tax Credit to $3,600 for children under age 6 and $3,000 for those between ages 6 and 17 for a year.

- raising the maximum Earned Income Tax Credit for a year.

- Reinstating the paid sick and family leave benefits that expired at the end of December until September 30.

- subsidizing through September the health-care premiums of those who lost their work-based health insurance

There is a lot in the plan. Direct payments to individuals, aid to small businesses, schools, and state and local governments, increasing tax credits, help for renters and child care, extension of federal eviction moratorium, increasing the minimum wage, health care assistance, and of course – improving the vaccine rollout. The magnitude of the plan makes it approximately equal to the CARES Act – the largest fiscal stimulus ever in U.S. history.

All of this creates another challenge – getting policies implemented to help Americans despite the divisiveness present in the country. The next section discusses why another round of stimulus needs to be done. Given the size and scope of the American Rescue Plan, there is no doubt that discussions and disagreements will occur between Americans, including politicians. However, the focus needs to be on getting things done, because much needs to be done. Respectful disagreements and discussions will hopefully lead to beneficial policy implementations for Americans. In many cases, successfully meeting these challenges could create significantly greater unity in America.

Why Another Round of Fiscal Stimulus?

The COVID-19 vaccine development and roll-out – daunting tasks considering the magnitude and logistics of the problem. According to the U.S. Census Bureau, at the beginning of 2021 the U.S. population was approximately 330 million, with adults 18 and older comprising about 75% of the population. Approximately 40 million Americans are age 65 and older. The U.S. government had a goal to vaccinate 20 million Americans by the end of 2020; only approximately 15% of that goal (3 million) was reached. By January 2021 over 400,000 Americans died from COVID-19.

As 2021 begins, much needs to be done in the vaccine rollout, from sufficient production of the vaccine to the logistics of distribution efficiency. The American Rescue Plan proposes significant funding to improve vaccine production and distribution. There may be differences over the scale of funding, and the intricacies of increasing vaccine production and improving distribution. However, fruitful discussions and the collective efforts of the government and private sectors can lead to a unified effort and jointly achieving the goals of protecting Americans and beating COVID-19.

In January, Federal Reserve Chairman Jerome Powell stated, “The single most important economic policy in this is health care policy. It’s getting control of the spread of the virus.” From a health and humanitarian perspective, controlling the virus is critical. From an economic perspective, controlling the virus is also critical.

Once again there can be disagreements over the scale of any program and particular provisions of the American Rescue Plan, but something needs to be done.

The Federal Reserve played a significant and pivotal role in helping the U.S. economy recover from downturns in 2001, 2008, and 2020 through lowering interest rates. The Federal Reserve’s monetary policy (buying and selling Treasury securities) strongly influences the movement of interest rates. The Federal Reserve targets the fed funds rate, a very short-term interest rate, which is the overnight borrowing rate between banks. When the Federal Reserve changes this rate, there is generally a rippling effect on other interest rates in the financial markets. In 2020, the fed funds rate was once again reduced to a historical low of 0.00-0.25% to counter the detrimental economic effects of COVID-19. In other words, if the economy is going to improve, fiscal policy (government spending and policies) rather than the Federal Reserve will be the driving force. Interest rates are already at historical lows.

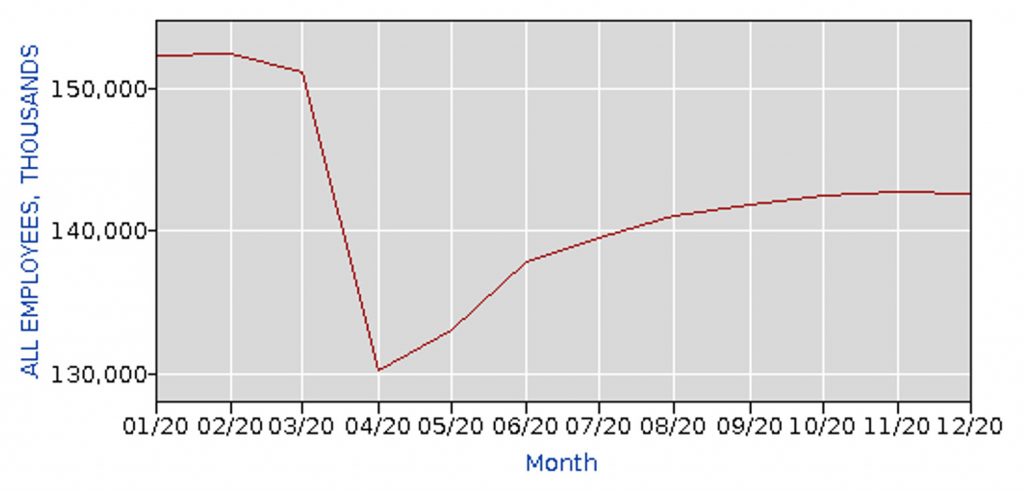

The economic recovery has stalled. The graph below (Chart 1) shows total nonfarm employment over the past year. 2020 began with employment over 152 million; the onslaught of COVID-19 on the economy reduced employment to only approximately 130 million by April. Employment grew back to approximately 142.7 million by November, but as the graph indicates, employment growth was slowing. In December, employment decreased by approximately 140,000 – the first decrease in employment since April. Total nonfarm employment is down by approximately 10 million jobs since a year ago – that is why another stimulus program is being proposed.

Chart 1 – All Employees, nonfarm Payrolls (seasonally adjusted)

The challenge for the current economy is also reflected by initial unemployment claims during the pandemic. According to the U.S. Department of Labor, during the financial crisis in 2008 and 2009 the weekly increase in seasonally adjusted unemployment claims varied between 321,000 and 665,000. During the pandemic, the weekly increase in seasonally adjusted unemployment claims peaked at 6.9 million in March and ended the year at 782,000. During the pandemic, the weekly increase in seasonally adjusted unemployment claims was greater in each week than the highest weekly increase of 665,000 recorded during the financial crisis.

Here are a few more challenges for another stimulus program. The economic impacts of COVID-19 on America have been significant and detrimental. But it has been more difficult for some Americans relative to others. Not all industries and jobs have been affected equally by the pandemic.

Table 1 below shows the unemployment rate by industry in December 2020 relative to December 2019. Every industry had a higher unemployment rate in December 2020 than in December 2019 (one more reason for another stimulus package). The leisure and hospitality industry (which includes food service and restaurants) has been particularly hit hard by the pandemic – harder than any other industry. Not surprisingly, the leisure and hospitality industry had the greatest increase in unemployment, from 5.0 percent in December 2019 to 16.7 percent in December 2020. The 16.7 percent unemployment rate was the highest for any industry in December 2020.

Table 1 – Unemployment Rates by Industry (not seasonally adjusted): Dec. 2019 vs. Dec. 2020

(Source: Bureau of Labor Statistics)

| Dec. 2019 | Dec. 2020 | |

| Mining, quarrying, and oil and gas extraction | 3.8 | 13.1 |

| Construction | 5 | 9.6 |

| Manufacturing | 2.7 | 4.3 |

| Durable goods | 2.5 | 3.5 |

| Nondurable goods | 3.1 | 5.5 |

| Wholesale and retail trade | 3.6 | 5.5 |

| Transportation and utilities | 2.6 | 8.4 |

| Information | 1.9 | 6.4 |

| Financial activities | 2.3 | 3.1 |

| Professional and business services | 3.1 | 6.1 |

| Education and health services | 2.4 | 4.1 |

| Leisure and hospitality | 5 | 16.7 |

| Other services | 3.2 | 7.4 |

| Government workers | 1.8 | 3.2 |

Table 2 below shows the average hourly earnings by industry in December 2020 relative to December 2019. The leisure and hospitality industry had the lowest wages for any industry, with average hourly earnings at $14.57 in December 2020, which was a slight decrease from the December 2019 rate of $14.77.

In other words, the industry with the highest unemployment rate also had the lowest wage rate. So, the industry with the highest unemployment had the employees that could least afford to lose their jobs. Another challenge for the American Rescue Plan, assure that those that need financial assistance the most receive it. In many cases, the hardest hit were low-income workers. Many people are facing financial difficulties.

One more point on the wage information presented in table 2. The second lowest wage group – retail trade, including grocery store workers, played a vital role in keeping essential products (like food) available to U.S. consumers. What workers get paid does not reflect how valuable they are.

Table 2 – Average Hourly Earnings: Dec. 2019 vs. Dec. 2020

(Source: Bureau of Labor Statistics)

| Dec. 2019 | Dec. 2020 | |

| Total private | $23.84 | $25.09 |

| Goods-producing | 25.07 | 25.78 |

| Mining and logging | 30.68 | 30.4 |

| Construction | 28.88 | 29.64 |

| Manufacturing | 22.44 | 23.12 |

| Durable goods | 23.42 | 24.14 |

| Nondurable goods | 20.83 | 21.5 |

| Private service-providing | 23.59 | 24.94 |

| Trade, transportation, and utilities | 20.83 | 21.7 |

| Wholesale trade | 26.15 | 27.14 |

| Retail trade | 16.88 | 17.94 |

| Transportation and warehousing | 22.5 | 22.95 |

| Utilities | 37.28 | 39.35 |

| Information | 34.44 | 36.11 |

| Financial activities | 28.06 | 29.73 |

| Professional and business services | 28.28 | 29.62 |

| Education and health services | 24.72 | 26.04 |

| Leisure and hospitality | 14.77 | 14.57 |

| Other services | 21.71 | 22.7 |

Once again there can be disagreements over the scale of any program and particular provisions of the American Rescue Plan, but something needs to be done. Chart 1 demonstrated that the economic recovery has stalled. Employment growth had been increasing in 2020 but was increasing at a decreasing rate until December when employment declined. There were 10 million fewer jobs at the end of 2020 compared to the beginning of the year. The data in Table 1 indicate that COVID-19 had a detrimental impact on every industry – unemployment was up in all industries in December 2020 relative to December 2019. The data in Table 2 indicate that the hardest unemployment hit was taken by the lowest paid industry. Many people are financially hurting.

Much needs to be done, from vaccine production and distribution to improving the economy. And beating the pandemic and improving the economy are related. Disagreements and discussions over proposed programs will certainly happen, but hopefully they will lead to beneficial policy implementations for Americans. The challenges are significant and not easy to meet. However, that is why collectively and successfully meeting these challenges would contribute to a greater spirit of accomplishment and unity in America.

For further information:

- The CARES Act and Supplemental legislation from the U.S. Treasury:

- The American Rescue Plan:

- From Investopedia: American Rescue Plan

- CNN: Biden Economic Rescue Plan

- The Tax Foundation: Biden American Rescue Plan

- NPR: Biden’s Plan to Rescue the Economy

- U.S. population data from the U.S. Census Bureau:

- From the Bureau of Labor Statistics:

- From the Department of Labor:

Kevin Bahr is a professor emeritus of finance and chief analyst of the Center for Business and Economic Insight in the Sentry School of Business and Economics at the University of Wisconsin-Stevens Point.