Overview

First, a few definitions. The federal budget deficit refers to the amount U.S. federal government spending exceeds government income. To finance a budget deficit, the government borrows money from the public through the issuance of U.S. government debt called U.S. Treasury securities. The Total Public (Federal) Debt Outstanding represents the total (principal) amount of Treasury securities outstanding issued by the federal government. Treasury securities include both marketable and non-marketable securities. Marketable securities trade in the (secondary) financial markets, and include Treasury bills, notes, bonds, and Treasury Inflation-Protected Securities (TIPS). The securities have different terms and provisions, but it’s all debt. Treasury non-marketable securities include savings bonds as well as special securities issued only to state and local governments. Non-marketable securities are not traded in financial markets. The Debt Limit (also referred to as the debt ceiling) is the maximum amount of money the government is allowed to borrow under authority granted by Congress.

In what has become an almost annual event, the debt ceiling and the possibility of the U.S. defaulting on its debt have once again entered political discussions. The argument against doing so is that increasing the debt ceiling may promote higher federal budget deficits and consequently increase the amount of U.S. Government (Treasury) debt. The argument in favor of raising the debt ceiling is that the U.S. will default on Treasury debt if the ceiling is not raised. The default would increase interest rates and borrowing costs for the U.S. government, individuals, and corporations resulting in significant negative economic consequences and investment losses for individuals and institutional investors.

A quick review of why the discussion on the debt limit (commonly called the debt ceiling) is currently taking place. The debt limit is the total amount of money that the United States government is authorized to borrow to meet its existing legal obligations, including Social Security and Medicare benefits, military salaries, interest on the national debt, tax refunds, and other payments. The debt limit does not authorize new spending commitments, which are determined by the Congress and president in the budget process. The debt limit allows the government to finance existing legal obligations that Congresses and presidents of both parties have made in the past.

The amount is set by law and historically has been periodically increased to allow the financing of government operations. According to the Congressional Budget Office, the Bipartisan Budget Act of 2019 (enacted in August 2019) suspended the limit through July 31, 2021. On August 1, 2021, the debt limit reset to the previous ceiling of $22.0 trillion, plus the cumulative borrowing that occurred during the period of suspension. The debt ceiling was raised in December of 2021 by $2.5 trillion to $31.381 trillion, which is expected to last until approximately summer of 2023. If the debt ceiling is not raised and the U.S. defaults on Treasury debt, there will be significant economic consequences.

According to the U.S. Treasury, “Congress has always acted when called upon to raise the debt limit. Since 1960, Congress has acted 78 separate times to permanently raise, temporarily extend, or revise the definition of the debt limit – 49 times under Republican presidents and 29 times under Democratic presidents. Congressional leaders in both parties have recognized that this is necessary.”

The Federal Budget Deficit and Total Public (Federal) Debt

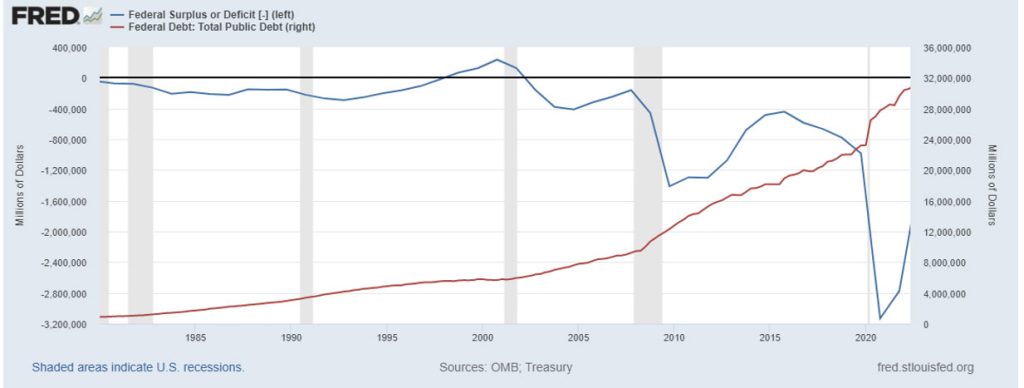

The graph below shows the relationship between federal budget deficits and the total public (federal) debt. The blue line (left axis) indicates the budget deficits or surpluses that have occurred since 1980. The onset of consistent budget deficits for the U.S. was the decade of the 1980s. Except for a brief period between 1998 and 2001 when the U.S. was enjoying excellent economic growth and the tech boom in its internet infancy, the United States has had budget deficits since 1980. Major events that played a role in significantly increasing the budget deficit include: 1) the financial crisis of 2008, 2) the tax cuts of 2018, and 3) the COVID crisis of 2020.

Economic downturns caused by the financial crisis and COVID had a double whammy on the budget deficit, evidenced by a significant reduction in tax revenues as economic growth turned negative and increased fiscal spending to stimulate economic recovery. The budget deficit usually decreases during periods of economic growth. That, however, changed with the tax cuts of 2018, which contributed to increasing budget deficits during a period of economic growth that began in 2010 and ended with the onset of COVID. Between 2015 and 2019, the budget deficit doubled to over $900 billion. The Congressional Budget Office estimated in 2018 that the tax cut would increase deficits by approximately $1.8 trillion over 11 years.

The red line (right axis) indicates the total public (federal) debt outstanding. Generally, the public (federal) debt outstanding reflects the accumulation of budget deficits, with subsequent budget deficits increasing the total public (federal) debt outstanding. Between 1980 and 2010, the debt rose from near $0 to approximately $10 trillion. Since 2010, the debt has approximately tripled to $30 trillion. Since 2008, two major economic downturns and the 2018 tax cut have fueled the debt increase.

Federal Budget Surplus or Deficit; Total Public Debt

The Economic Consequences of Debt Default

Which investors get hurt if the government defaults on Treasury debt? Who buys this stuff? Buyers include individuals (you could open an online account with the U.S. Treasury and purchase these securities), large institutional investors, certain mutual funds, pension funds, foreign investors, state and local governments, businesses, and certain U.S. government agencies. For a more complete breakdown, Table 1 below shows the detail of Treasury debt ownership provided by the U.S. Treasury. The table provides insight as to who could potentially be harmed if the U.S. defaults on its debt.

Table 1. Estimated Ownership of U.S. Treasury Securities

(billions of dollars)

| Total public debt | Federal Reserve and Gov. Accounts | Total privately held | Depository institutions | U.S. savings bonds | PENSION FUNDS Private | PENSION FUNDS State and Local gov. | Insurance cos. | Mutual funds | State and Local Gov. | Foreign & Intl. | Other Investors | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2022 June | 30,568.6 | 12,399.7 | 18,168.9 | 1,807.7 | 160.4 | 767.6 | 381.1 | 368.2 | 2,842.6 | 1,547.2 | 7,430.8 | 2,863.5 |

| 2021 March | 28,132.6 | 11,095.5 | 17,037.1 | 1,348.4 | 145.7 | 797.7 | 332.6 | 388.1 | 3,631.3 | 1,166.4 | 7,028.4 | 2,198.5 |

| 2020 Dec. | 27,747.8 | 10,809.2 | 16,938.6 | 1,265.7 | 147.1 | 816.0 | 353.2 | 398.2 | 3,552.9 | 1,150.3 | 7,070.8 | 2,184.5 |

The following is a list of who and what could potentially be harmed if the U.S. defaults on its debt:

- Any retiree receiving or expecting to receive payments from Social Security

- Workers having a pension fund that invests in Treasury securities, including private employees, federal employees, military, and state and local government employees

- Individuals investing in Treasury securities, including Savings bonds

- Insurance companies and depository institutions that invest in Treasury securities

- Investors in money market mutual funds, or any fund that invests in Treasury securities

- State and local governments that invest in Treasury securities

- Foreign investors that purchased Treasury securities

- All U.S. taxpayers

- Consumers and businesses

- The U.S. economy

As of June 2022, a total of $30.56 trillion of U.S. public (federal) debt was outstanding. Almost $12.4 trillion was held by the Federal Reserve and U.S. government agencies, with $18.16 trillion privately held. More specifically, according to the U.S. Treasury, approximately $6.6 trillion of Treasury securities were held by government agencies. Government agencies may invest in Treasury securities, generally viewed as a safe investment, if they have a temporary surplus of cash. The largest government agency investing in Treasury securities – Social Security.

Employers and employees each pay 6.2% (up to a salary limit of $160,200 in 2023) of an employee’s earnings for Social Security; 1.45% of earnings for Medicare. These current tax payments into Social Security are being dispersed to those receiving benefits now – any excess payments remain in Social Security trust funds. There are separate trust funds for retirement and survivors benefits [the Old-Age and Survivors Insurance (OASI) Trust Fund], disability benefits [the Disability Insurance (DI) Trust Fund], and Medicare. The Social Security Trust funds can purchase Treasury securities as an investment until funds are needed to pay benefits. In recent history current tax payments exceeded disbursements, but that changed in 2021 when disbursements exceeded tax payments for the first time since 1982. A June 2022 report released by Social Security indicated that the OASI Trust Fund is expected to be depleted by 2034, as annual disbursements are expected to exceed tax payments. Out of the $6.6 trillion total of Treasury securities held by government agencies in June 2022, the Social Security trust fund for retirement and survivors benefits (the OASI Trust Fund) owned approximately $2.8 trillion. If the U.S. government defaults on Treasury securities, the OASI Trust Fund could lose the funds invested in Treasury securities and could become depleted earlier. This could cause a reduction in benefits for retirees unless other sources of revenue are available. Other government funds that invest in Treasury securities that could lose money if defaults occur include the Military Retirement Fund, Medicare, Disability Insurance Trust Fund, and the Postal Service Retirement Fund.

Private pension funds and pension funds for state and local government employees combined for ownership of approximately $1.1 trillion of Treasury securities as of June 2022. Any default by the U.S. government could reduce the value of these pension assets, and consequently lower retirement benefits for pension plan participants.

Have you ever invested money in a money market mutual fund thinking it was a relatively safe investment? It was, but that could change if the U.S. government defaults on Treasury securities. Mutual funds, including money market mutual funds, invested over $2.8 trillion in Treasury securities as of June 2022.

Insurance companies and depository institutions combined for over $2.1 trillion of Treasury security holdings in June 2022. A default by the U.S. government could put a financial strain on the institutions holding Treasury securities. State and local governments owned nearly $1.5 trillion. Defaults on Treasury securities could result in a loss of funds needed by state and local governments to meet expenses.

U.S. Treasury debt owned by foreign investors was over $7.4 trillion in June 2022. Japan ($1.236 trillion), China ($967 billion), and the United Kingdom ($616 billion) ranked as the top holders of U.S. Treasury securities. These three countries combined for owning approximately 38% of the Treasury debt held by foreign investors. Any default would not be well received, and foreign investors have been a key source of financing for the United States, owning approximately 25% of outstanding Treasury debt. If foreign investors become wary of holding Treasury debt in the future, that source of financing would be difficult to replace. In addition, a decrease in the attractiveness of U.S. investments would weaken the U.S. dollar relative to foreign currencies, and the cost to the American consumer of imported goods would increase.

From a broader perspective, all U.S. taxpayers would be negatively impacted if the U.S. government defaults on Treasury securities. A default would rattle the bond market and cause interest rates to increase. If the U.S. needs to borrow more money in the future (and it will), that debt just became riskier for investors and a lot more costly to the federal government. There is a link between risk and return in the financial markets. More risk, more return is needed by investors. That would translate to higher interest rates on Treasury securities, and higher borrowing costs for the U.S. government and higher costs for taxpayers to repay. Would you lend money to the U.S. government knowing that you might not get repaid?

In 2021, when the U.S. was on a similar path of potentially defaulting on Treasury debt by failing to raise the debt ceiling, Moody’s Analytics estimatedthat a prolonged impasse and failure to raise the debt ceiling would cost the U.S. economy up to 6 million jobs, reduce household wealth by $15 trillion, significantly increase interest rates, and cause a steep decline in the stock market. In the current environment of an economic slowdown and potential recession, the debt default would likely lead to a major recession.

Failure to raise the debt limit would have significant, negative effects on the financial markets. Higher required interest rates on future Treasury debt resulting from the increased risk would ripple through the economy and financial markets, increasing borrowing costs for businesses and consumers which would exacerbate any economic slowdown. Declining consumer spending, increasing unemployment, lower corporate profits and higher borrowing costs would make a bad combination for the stock market, which would come on the heels of a difficult 2021 when the S&P 500 declined over 19%.

The United States is viewed as the global economic leader and the U.S. dollar is the global economy’s reserve currency. The fact that the U.S. government has paid its debts in a timely and predictable manner has been integral to the global economic and financial system. Treasury securities have been the benchmark for safety in the bond markets, due to the financial guarantee by the U.S. government that the investor will receive payment. Failure to continue this promise will increase U.S. interest rates and costs to taxpayers for decades to come. If the United States wishes to remain a global economic leader, stiffing foreign and domestic investors, hurting retirees (including private employees, federal, state, and local government employees, and military), negatively impacting international financial markets, and causing a global economic recession isn’t the way to do it. The U.S. would likely find it difficult to recover from the fall in reputation that would result in the international markets from any Treasury debt default.

In summary, there is much to be lost by many parties if the U.S. defaults on Treasury securities and the debt limit is not raised. Investors, retirees, U.S. taxpayers, businesses, consumers, financial markets, and the reputation of the U.S. as a global economic leader, would all take a hit. According to the United States Office of Government Ethics: “United States Treasury securities, often simply called Treasuries, are debt obligations issued by the United States Government and secured by the full faith and credit (the power to tax and borrow) of the United States.” If the U.S. defaults on Treasury securities, so much for believing the full faith and credit clause. Ultimately, the proper way to deal with debt is not through defaulting on promised debt payments, but through timely and appropriate revenue and spending policies.

For further information:

- From the U.S. Treasury:

- From the Congressional Budget Office

- Data on Treasury Debt from the U.S. Treasury: Treasury Bulletin

- Major Holders of U.S. Treasury Securities from the U.S. Treasury: https://ticdata.treasury.gov/Publish/mfh.txt

- From Social Security

- From Moody’s Analytics: Playing a Dangerous Game with the Debt Limit

- From the U.S. Office of Government Ethics: Treasury Securities

- From the Committee for a Responsible Federal Budget: Everything You Should Know About the Debt Ceiling

Kevin Bahr is a professor emeritus of finance and chief analyst of the Center for Business and Economic Insight in the Sentry School of Business and Economics at the University of Wisconsin-Stevens Point.