Unfortunately, the divisiveness in America is significant and undeniable. It stretches across politics, race, gender, religion and economic issues. This Center for Business and Economic Insight (CBEI) series takes a look at the economic challenges of 2021, and also incorporates the divisiveness issue into some of the discussions. For many economic challenges, the overall economic health of the country would benefit if divisions could be reduced. Not differences, but divisions.

Challenges can be met and the United States can accomplish much when political divisions are set aside and the focus becomes helping the American people. The Bipartisan Policy Center provides an impressive, historical list of accomplishments when Democrats and Republicans worked together to improve the lives of Americans. Listed below are some of those accomplishments:

- 1964 Civil Rights Act: A civil rights bill proposed by congressional Democrats and supported by the Johnson administration needed significant bipartisan support to pass and become law. Democratic majority leader Mike Mansfield worked with his counterpart, Republican Senator Everett Dirksen, to get the bill passed.

- 1969 Moon Landing: The National Aeronautics and Space Administration (NASA) was created in 1958 through bipartisan Congressional support. NASA led the development of the U.S. space program, resulting in the 1969 launch of Apollo 11 and Neil Armstrong walking on the moon.

- 1983 Social Security Reform: In the early 1980s, the Social Security Trust Fund was trending toward a deficit. Party leaders Republican Senator Bob Dole and Democratic Senator Daniel Patrick Moynihan led a bipartisan group of legislators that were able to transform recommendations into legislation that financially strengthened and reformed Social Security.

- 1990 Americans with Disabilities Act: Long overdue, the act finally made it illegal to discriminate against people with disabilities. The act was passed with bipartisan support; Republican Senator Bob Dole and Democrat George Mitchell played leading roles in the act’s passage.

- 2010 Tax Deal: The 2003 Bush Tax cuts were set to expire at the end of 2010, unless extended by Congress. The Obama administration worked a bipartisan compromise that kept the tax cuts in place but increased the rate in the top tax bracket.

For further information on what can be accomplished with political working together, from the Bipartisan Policy Center: History of Bipartisanship

And now, the challenges for 2021.

Challenge #1: COVID-19 and the 2021 Economy

The primary driver of U.S. economic growth in 2021 will likely be a repeat of 2020: COVID-19. The importance of the interrelationship between individual health, health care and the economy has never been so apparent.

The United States economy typically chugs along at a pretty good pace unless there is a bump or shock to derail its progress. The key is to get the economy moving forward – precipitating a snowballing effect, where economic growth continues until something happens to stop it. When economic growth occurs, increased employment leads to more consumer spending, which leads to more economic growth. Consumer spending is generally the primary driver of U.S. economic growth, as it comprises approximately two-thirds of Gross Domestic Product (GDP). GDP is the benchmark for economic growth and measures the value of goods and services produced in a given period. Likewise, a snowballing effect can occur in the opposite direction. If consumer spending declines economic contraction continues until something happens to reverse it. If something happens to derail consumer spending, that’s where fiscal policy (spending by the U.S. government) and/or monetary policy (the Federal Reserve reducing interest rates) can be used to put consumer spending back on track.

Fiscal policy can include spending on specific programs by the federal government and stimulus programs featuring direct payments to individuals. Although a variety of factors influence interest rates, the Federal Reserve’s monetary policy (buying and selling Treasury securities) strongly influences the movement of interest rates. The Federal Reserve targets the fed funds rate, a very short-term interest rate, which is the overnight borrowing rate between banks. When the Federal Reserve changes this rate, there is generally a rippling effect on other interest rates in the financial markets. Lower interest rates generally increase consumer spending. Higher interest rates generally lower consumer spending. The goal of the Federal Reserve – balance economic growth with acceptable levels of inflation.

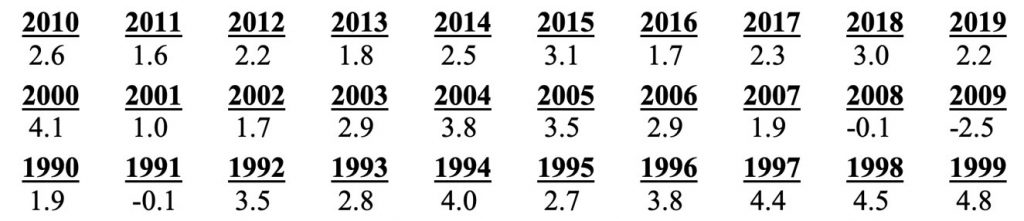

The table below shows U.S. economic growth as measured by the annual percentage change in GDP over the last 3 decades. As stated earlier, generally the U.S. economy chugs along unless there is a bump or shock to derail it. Over the last three decades economic growth was positive in 27 out of 30 years.

Annual Percentage Change in GDP

An economic bump occurred in 1991 due to the Federal Reserve increasing interest rates and an oil price shock. By 1990 the rate of inflation (as measured by the change in the Consumer Price Index) exceeded 5%; the Federal Reserve countered by increasing the fed funds rate to lower consumer spending and reduce inflation. It might seem hard to believe given the low interest rates of the last decade, but in July 1990 the fed funds rate stood at 8.0%. An oil price shock also occurred as oil prices more than doubled in 1990 in response to the Iraqi invasion of Kuwait. Decreasing inflation and a reversal of oil prices led to a slashing of interest rates by the Federal Reserve from 8.0% in July 1990 to only 3.0% in September 1992. Low interest rates and the dot.com boom, the rise of internet and technology companies, paved the way for strong economic growth in the 1990s with four years of economic growth of 4.0% or greater.

The United States began the new century with a variety of bumps to the economy. The dot.com bubble was over, with over-hyped tech and internet stocks crashing back to reality. The technology heavy Nasdaq index declined over 75% between March 2000 and October 2002. The September 11, 2001, terrorist attacks contributed to the economic decline, as uncertainty and fear gripped the economy. In addition, the financial markets were plagued by accounting scandals (Enron). Although GDP growth was positive for the entire 2001 year at 1.0%, economic growth was negative for two quarters resulting in a minor recession.

Fiscal and monetary policy were jointly used to combat the effects of the 2001 recession. The strong economy in the 1990s caused the Federal Reserve to gradually ramp up interest rates with the fed funds rate hitting 6.5% in May 2000. The economic decline in 2001 caused the Federal Reserve to change course, and the fed funds rate was reduced 10 times in 2001 to a year-end low of 1.75%. In 2003 the rate was lowered to 1.00%, and fiscal policy included the Bush Tax Cuts. In addition to lowering tax rates by income bracket, the Bush Tax Cuts lowered taxes on certain dividends (cash payments to shareholders) and long-term capital gains (gains on financial assets). The resulting combination of fiscal and monetary policy contributed to economic growth that lasted through late 2007.

By late 2007, a major shock to the U.S. economy was beginning. Credit was easy and mortgage backed securities allowed a transfer of risk from lenders to investors in mortgage backed securities. Although a myriad of factors contributed to the financial crisis, rising interest rates lit the fuse for the economic implosion. As the economy rebounded from the 2001 recession and concerns over inflation grew, the Federal Reserve increased rates multiple times, from 1.00% in 2003 to 5.25% in 2006. The increasing rate not only dampened the economy, but it also paved the way for increasing monthly mortgage payments on adjustable rate mortgages. The up-tick in interest rates resulted in many home buyers not being able to pay monthly mortgage payments; many homes were put up for sale. The result – home prices plummeted, defaults occurred on mortgage loans and mortgage-backed securities, foreclosures increased significantly, and the economy and stock market began a decline in late 2007 that lasted until early 2009 (the S&P 500 declined by nearly 60%).

The defaults on mortgage loans and mortgage backed securities led to a credit crisis in the financial markets (banks did not have the liquidity to make loans) and a lack of consumer and investment spending by business. The Federal Reserve began slashing interest rates in an effort to counter the negative economic impact of the financial crisis. In 2008 the Federal Reserve cut the fed funds rate 7 times; by year-end, the rate was at a historical low of 0.00-0.25%. Fiscal policy included an $800 billion stimulus package that was implemented in 2009 and a temporary reduction in the Social Security withholding tax from 6.2% to 4.2% in 2011 and 2012. The resulting combination of fiscal and monetary policy contributed to the longest period of economic growth on record – 128 months, from July 2009 through February 2020.

In 2020 the economic shock was COVID-19. After a brief, temporary kick-up in economic growth in 2018 due to the 2018 tax cuts, the economy began slowing in 2019 and came to a screeching halt in 2020.

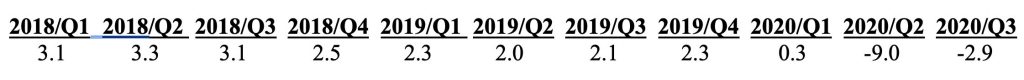

Percent Change from Quarter One Year Ago – Real GDP

The Bureau of Economic Analysis (BEA) began tracking quarterly GDP growth data in 1947. The 2020 second quarter drop was the worst on record, and much greater than the worst quarterly decline during the financial crisis. When comparing economic growth to the previous quarter of a year ago, the 2020 second quarter decline of -9.0% was significantly worse than the largest financial crisis quarterly decline, which was -3.9% in the second quarter of 2009. Third quarter 2020 GDP was still 2.9% lower than a year ago.

Once again, a combination of fiscal and monetary policy was used to combat the effects of an economic shock. The Federal Reserve had already reduced interest rates 3 times in 2019 as the economy slowed due to trade wars and the effects of the tax cuts subsiding. However, in 2020, the fed funds rate was once again reduced to a historical low of 0.00-0.25% to counter the effects of COVID-19. In March, a $2 trillion fiscal stimulus package was passed that more than doubled the $800 billion stimulus package that was implemented in 2009 to overcome the financial crisis. The fiscal and monetary measures would help combat the problem, but they couldn’t solve the problem.

COVID-19 put the brakes on consumer spending, resulting in an economic downturn in 2020. Unfortunately, COVID-19 also became political. There became an illusion of an economic choice: 1) limit the growth of the pandemic by closing the economy down and minimizing economic growth, or 2) maximize economic growth by completely opening-up the economy and accepting the spread of COVID-19. In reality, COVID-19 was going to impact the economy, whether the economy was closed down or opened-up. The primary factor to future economic growth and minimizing any economic downturn was not about re-opening the economy, the primary factor was getting the virus under control. If Americans felt safe shopping, traveling and spending at retail businesses, consistent economic growth would return. The promising vaccine news in November will hopefully lead to a quick return to more normal conditions; however, even distribution of the vaccine will take some time. In the meantime, appropriate policy planning could allow fiscal policy to be used preemptively to offset the damaging economic effects of the virus on individuals and businesses, especially small business.

The greater the unity by Americans in fighting the virus, the faster the virus will be controlled and the faster consistent economic growth returns. That’s the key for this pandemic, and any future pandemic. COVID-19 was going to impact the economy, the question was how much and how long it would impact the economy. The quicker the virus was controlled then the quicker consistent economic growth would return. Exactly when that happens is the big question for 2021.

For further information:

- GDP Growth (and other national data) from the Bureau of Economic Analysis: GDP Growth

- Info on Economic cycles from the National Bureau of Economic Research: Economic Cycles

- Info on inflation from the Federal Reserve Economic Database (FRED): FRED Database – Inflation

- The fed funds rate since 1990 from the Federal Reserve: Fed Funds Rate

CBEI Series: Divisiveness and the Economic Challenges of 2021

Challenge #1: COVID-19 and the 2021 Economy

Challenge #2: Controlling U.S. Debt and Federal Budget Deficits

Challenge #3: Manufacturing and Trade

Challenge #4: Healthcare

Challenge #5: U.S. Economic Leadership

Challenge #6: Wages

Kevin Bahr is a professor emeritus of finance and chief analyst of the Center for Business and Economic Insight in the Sentry School of Business and Economics at the University of Wisconsin-Stevens Point.