Number 5: Drivers of The Stock Market

The S&P 500 index is a benchmark index for measuring the performance of the U.S. stock market. It is a diversified index that contains the stocks of 500 relatively large companies (large cap) in an array of industries. Stock prices reflect expectations of future corporate profitability – more specifically, the earnings and cash flow expected for each share of a company’s stock. If earnings or the growth rate of earnings decrease, a company’s stock price will generally decrease. If the stock market becomes riskier due to economic uncertainty (such as the recent financial and economic crisis, or tariffs), then stock prices will decrease. Recent stock market performance – up, down, and all around over the past decade, but generally up.

Annual Return of the S&P 500 Index since the Financial Crisis

A number of factors have impacted the stock market to varying degrees at various points in time. Listed below are (not listed in any particular order) some of the more important drivers that have recently impacted stock market performance.

The Tax Cuts

Since stock prices reflect expectations of future corporate profitability, the 2018 tax cuts arguably contributed to a strong stock market in 2017. The corporate tax rate was lowered from 35% to 21% in 2018. In addition, capital expenditures (spending on property, plant, and equipment) could be expensed (a tax deduction in the year of the expense) rather than depreciated (allocating the cost and spreading the deduction over the life of the property). Both changes contributed to a strong stock market in 2017 and a general expectation of increased corporate profitability and economic growth. Companies were awash in cash.

Share Buybacks

The 2018 tax bill significantly increased corporate profitability and cash flow. If companies have excess cash after making necessary and desired expenditures, what can they do with it? One option – share buybacks. Share buybacks allow companies to increase their stock price, as the total earnings of the company will be divided between fewer shares. In other words, share buybacks will have a positive impact on earnings per share, which in turn will increase the stock price.

The 2018 tax bill contributed significantly to a dramatic increase in share buybacks. According S&P Dow Jones Indices, share buybacks hit their highest level in history in 2018. The total value of share repurchases by companies reached a record $806.4 billion in 2018, up 55 percent from 2017. The 2018 record level was more than 36 percent higher than the previous high in 2007. Despite the huge increases in 2017 and 2018, share buybacks were on pace to potentially reach a record $1 trillion in 2019.

Interest Rates

Theoretically, the Federal Reserve acts in an independent manner to balance economic growth with inflation. The Federal Reserve tries to accomplish this goal through targeting the “fed funds rate” – a very short-term interest rate that when changed, typically has a rippling effect through the financial markets. The Federal Reserve influences this rate by primarily controlling the money supply in the United States. The amount of money circulating in the economy has an impact on interest rates and credit conditions – more money, lower interest rates; less money, higher interest rates. The rate is lowered when the Federal Reserve increases the money supply through purchasing Treasury securities (technically called Open Market Operations).

After 2008, in an effort to help the economy recover from the financial and economic crisis, the Federal Reserve periodically and aggressively purchased short and long-term Treasury securities (“quantitative easing”) in an effort to keep interest rates low. These lower interest rates contributed to the U.S. gradually and successfully recovering from the economic recession caused by the financial and economic crisis. In a similar fashion, the fed funds rate was aggressively lowered in 2001 to help the U.S. economy recover from an economic recession, at least partially caused by the Sept. 11 terrorist attacks. From 2015 through 2018, as a result of an improving economy and at least some expectation of an increased risk of inflation, the Federal Reserve increased interest rates several times. Things reversed in 2019. Growing concern over a global economic slowdown and the negative impact of tariffs on the U.S. prompted the Federal Reserve to cut interest rates three times as of November 1, 2019 (something that was encouraged by the Trump Administration). The result has been a decline in short-term and long-term interest rates in the financial markets.

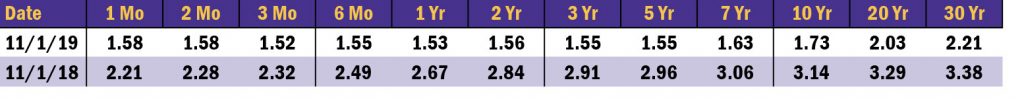

The chart below shows the Treasury yield curve on November 1, 2019 relative to one year ago. The Treasury yield curve shows the relationship between short-term and long-term interest rates. Across the board, all rates declined relative to one year ago. Lower rates encourage borrowing and spending – factors contributing to economic growth and the strong stock market in 2019. However, given the current level of extremely low rates, it may be difficult for any further reduction of interest rates to have a significant, positive factor on either economic growth or the stock market.

Treasury Yield Curve Rates

Tariffs

Tariffs are paid by an importing company (NOT a country) and reduce corporate profitability and cash flows. In 2018 the United States had placed tariffs on goods from several countries, including Canada, Mexico, India, South Korea, the European Union, and China. Tariffs were placed on imported goods such as aluminum, steel, consumer goods, and industrial products. Retaliatory tariffs were often implemented by these countries on goods imported from the United States. These goods included agricultural products, whiskey, and motorcycles. Tariffs arguably dominated the declining stock market performance in 2018. According to the Peterson Institute for International Economics, by September 2018 the United States had tariffs on 12 percent of its total imports, while the combined trading partner retaliation covered 8 percent of total US exports. The tariffs, and the prospect of future additional tariffs contributed to a declining stock market, as the impact of tariffs on corporate profits created market uncertainty.

In 2019 the financial markets reflected a growing optimism and expectation that the trade wars would at least subside, particularly with China. This optimism, combined with lower interest rates, continued economic growth, and share buybacks, powered the stock market through November.

For further information:

- From Morningstar, info on S&P 500 performance and the financial markets

- From S&P Global, info on share buybacks

- From the Federal Reserve, a history of the fed funds rate

- From the Peterson Institute for Economics, a timeline on the U.S. trade war

CBEI Blog Series: The Economy: 5 Things You Should Know for 2020 (and Beyond)

Part 1: Economic Growth and Unemployment – Positive Trends for a Long Time

Part 2: What’s Been Driving Economic Growth

Part 3: The Timing of Those Tax Cuts

Part 4: The Yet to be Paid Increasing Costs of the Federal Deficit and Debt

Part 5: Drivers of The Stock Market

Part 6: Summary and Future Challenges

Kevin Bahr is a professor emeritus of finance and chief analyst of the Center for Business and Economic Insight in the Sentry School of Business and Economics at the University of Wisconsin-Stevens Point.