Project 2025 has recently received significant attention and has been the subject of much discussion. Project 2025 features a 900-page plan for government administration (Mandate for Leadership) that provides domestic, political and economic policies which would significantly transform the U.S. government and American society. It was created by the Heritage Foundation, a conservative think tank […]

More...Category Archives: Center for Business and Economic Insight

2024 Mid-Year Economic Update

The U.S. economy continued to roll along in the first half of 2024. Economic growth continued, inflation decreased and the labor market was relatively strong. The strong economic performance was reflected by record stock market performance. The U.S. S&P 500 index (a benchmark index for U.S. large company stocks) and the NASDAQ index (technology index) […]

More...Economic Performance: 2017-2024

The U.S. economy has been the subject of much discussion with differing viewpoints. This report will hopefully shed light on U.S. economic performance by analyzing a broad range of economic variables over the period from January 2017 through March 2024. Changes in these variables, as well as the reasons why these variables changed, will be […]

More...CBEI Central Wisconsin Spring 2024 Report and a Quick Trip around the GLOBE

Thank you, Kyle and Congratulations, Michael! by Scott Wallace As the director of the Center for Business and Economic Insight (CBEI), I have been enormously fortunate to have worked with truly outstanding students. Our senior research assistant Kyle Pulvermacher (who is graduating next week) has made significant and lasting contributions to the Center for Business […]

More...Tariffs and Trade

Republican presidential candidate Donald Trump has indicated that he would place a 10% tariff on all products imported into the United States if elected president, with potential tariffs of up to 60% on goods imported from China. This blog will discuss recent tariffs, trade, and the potential impact of a 10% (at least) blanket tariff […]

More...Job Growth

In January, the Bureau of Economic Analysis released its preliminary estimate for fourth quarter 2023 economic growth in the United States. Economic growth is measured by changes in Gross Domestic Product, which is the value of goods and services produced in a given time period. Although rising interest rates slowed the economy in the first […]

More...Social Security – Too Much to Retirees?

2024 will likely be another year of wrangling over government expenditures by Congress. Social Security is the largest government expenditure and expected to grow in the future due to the aging of the American population. Does Social Security pay too much to retirees? This blog provides a quick example of what Social Security typically pays to […]

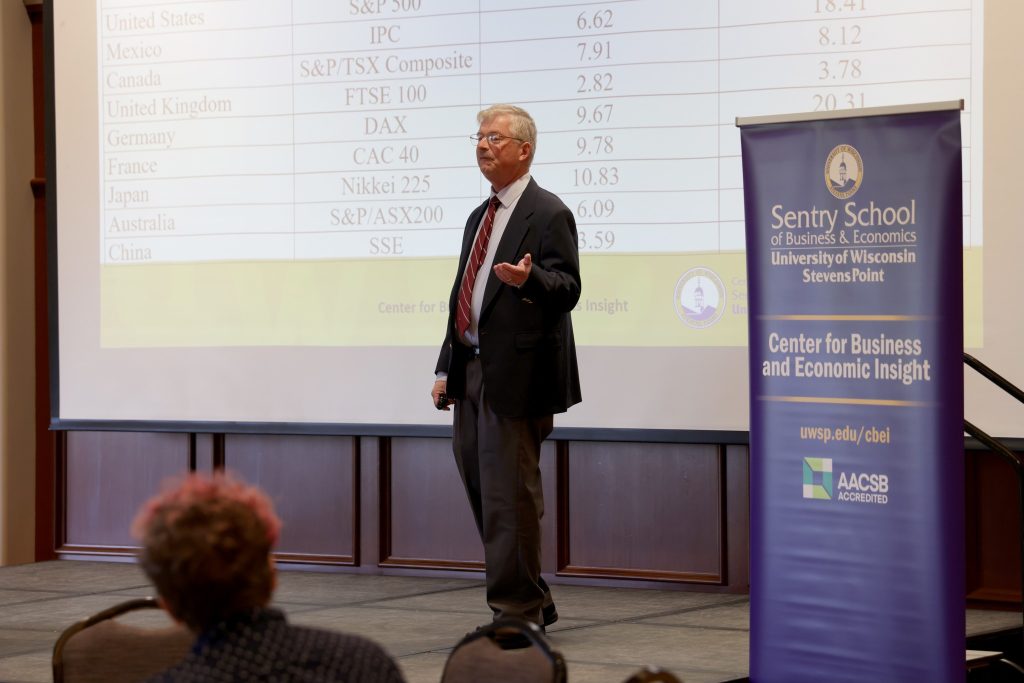

More...2023 Global Stock Market Review

2023 began with more pessimism than optimism for global economies and stock markets. Global inflation was rampant in 2022; as a result, central banks around the world began raising interest rates in an effort to battle inflation through lower economic growth and consumer demand. Stock prices reflect expectations of future corporate profitability, so higher interest […]

More...Economic Review 2023 and What’s Ahead for 2024

This report will provide a summary of the 2023 performance for a myriad of economic measures and offer a glimpse of what’s on the economic horizon for 2024. In addition, the underlying factors that drove the economic changes in 2023 will be explored. Overall, and relative to most developed countries, the U.S. economy performed extremely […]

More...Insight Spotlight: Practicing Storied Leadership: Why Business Leaders Should Tell More Stories

by Reed Stratton, Associate Professor of Business What happens in Vegas stays in Vegas, but the Vegas Strip is everywhere. Your email inbox is the Vegas Strip. Your chiming, pinging, glowing cell phone is the Vegas Strip. Even your walk through the store for milk is the Vegas Stip. The Vegas Strip, with its glittering, […]

More...